Value of growth

Article

Article

Mass, Nathaniel J. “The Relative Value of Growth.” Harvard Business Review (April 2005).

Summary

In this article, Nathaniel Mass makes the case that growth is as important to the bottom line as margin and that the two aren’t mutually exclusive. Mass presents a metric called the relative value of growth, or RVG, and the analytic framework to support it, so that firms can better analyze and grasp the importance and compounding benefits of growth.

Reviewer

Dr. Michael Boehlje, Professor Emeritus, Department of Agricultural Economics

What this means for food and agricultural businesses

Given the current financial and economic downturn for the farm and agribusiness sectors, almost everyone is talking about how to protect margins. Margin management through cost control or better informed product pricing decisions is critical to financial success. But what about revenue growth? How important is it? Which has the potential to create the most value for the firm over time? Which should be the focus of the long-term strategy of the business? Those are the questions that Nathaniel Mass discusses in his 2005 Harvard Business Review article, “The Relative Value of Growth.”

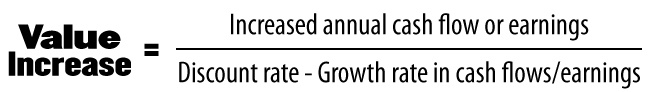

Mass argues that the value enhancement of growth in operating earnings through increased sales compared to margin improvement from cost reductions can be determined through the standard discounted cash flow analysis model summarized as:

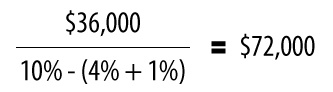

To illustrate, assume revenues/sales of $30,000,000 and margins of 12 percent, which results in annual operating earnings of $3,600,000, a discount rate of 10 percent, and historical growth in operating earnings of 4 percent per year.

If the growth rate in earnings is increased by 1 percent—from 4 percent to 5 percent per year—earnings in the next year will increase by $36,000 more than they would have at the 4 percent growth rate and will compound into the future if this higher growth rate continues. The future value of this increased growth in earnings is calculated as:

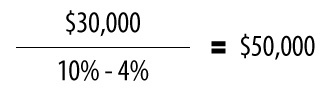

If margins are improved by 1 percent per year through cost reductions with no improvement in the rate of growth in sales, the value of this improvement is:

If margins are improved by 1 percent per year through cost reductions with no improvement in the rate of growth in sales, the value of this improvement is:

The implications of these calculations are that growth in sales revenue and operating earnings typically creates more value for the firm over time than a similar percentage increase in margins through cost reductions.

The implications of these calculations are that growth in sales revenue and operating earnings typically creates more value for the firm over time than a similar percentage increase in margins through cost reductions.

Mass argues that many businesses don’t fully appreciate the relative value of growth of sales/revenues compared to increases in margins. Growth might be harder to achieve, and sometimes compensation is not adequately linked to growth objectives to incentivize and reward the tough decisions to grow revenues through creative marketing/sales programs rather than price discounting. Some managers believe that there is a growth versus margin tradeoff whereby you have to give up margins to achieve high growth rates in revenues. Mass argues that successful companies understand the critical balance between growth and margins. He says that, “Adding a point of sustainable growth may be harder to achieve than improving your company’s margin, but as many companies have found, the largest profits usually go hand in hand with the fastest growth. It’s time we put an end to the idea that the two are incompatible.”

This is a critical point to remember during this current downturn when short-term margin pressures and cost control strategies might dominate our thinking at the expense of recognizing the relative value of revenue and growth to the long-term success of the business.

Read Mass’s article and use his logic and procedures to calculate the strategic value of growth enhancement versus margin improvement for your company. And then work with your marketing and sales team on sales growth and your operations management and staff on cost reductions and margin management to improve them both. In reality, a combination of higher margins and increased sales growth will multiply your bottom line profit performance and you can achieve them both at the same time.

RELATED POSTS:

A great moment for value-based sales in agribusiness

Value-based sales can empower companies to craft compelling value propositions, understand the customer’s business model and effectively communicate to stakeholders.

How can big data empower the development of new products?

Data is one of the most powerful resources for a company. It enables accurate decision-making and minimizes risk, ensuring greater revenue and sustainable growth.

Unlocking Growth: Exploring innovation dynamics in the agrifood sector

The future for the agrifood sector appears promising, driven by technological advances, strategic M&A activity and a growing commitment to innovation.