Managing customer relationships

Article

Article

Dalsace, Frédéric and Sandy Jap. “The friend or foe fallacy: Why your best customers may not need your friendship.” Business Horizons 60 (2017), 483-493.

Reviewer

Dr. Michael Gunderson, Director and Professor

Summary

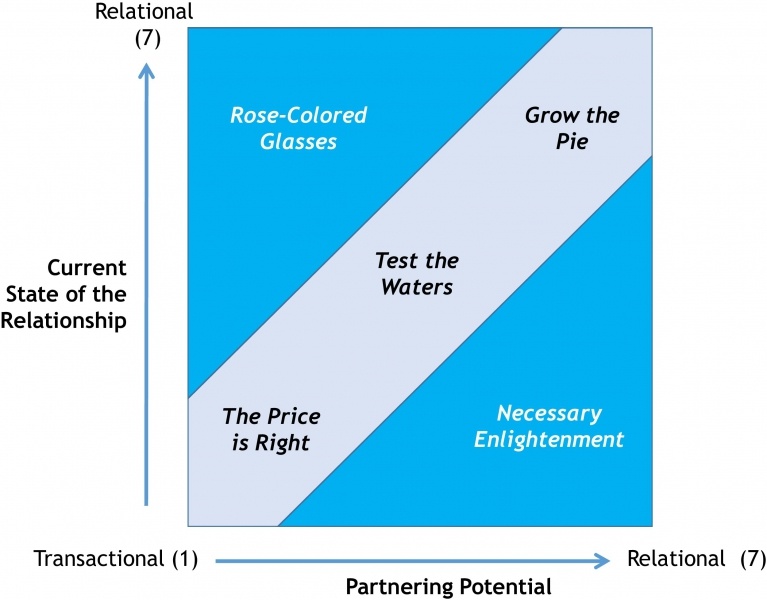

The authors of this article take an economic approach to building customer relationships. Specifically, whether the benefit of close customer relationships exceed the costs. The matrix presented (Figure 1) contrasts the partnering potential and current state of the relationship. The authors suggest that customers will typically fall into five different groups: “The Price is Right,” “Test the Waters,” “Grow the Pie,” “Rose-colored Glasses,” and “Necessary Enlightenment.” Using data collected from MBA students, the authors conclude the distribution of customers is not uniform. The distribution of that data is unlikely to be useful for informing the distribution of your organization’s customer base. However, the authors present a useful set of questions to guide your own analysis.

What this means for food and agribusiness

Particularly among agricultural retailers, I hear many are struggling with customer value creation and delivery, employee turnover and customer loyalty. These factors are interrelated and influence the lifetime profitability of a customer relationship. This article challenges sales managers to think critically about collaborating with top customers. Instead, the authors suggest managing the closeness of the relationship by assessing the true benefits that come from collaboration.

Many of our agricultural retailers are interested in serving all producers in a geography. Often retailers want to serve all farmers fairly. Treating them equitably, however, might not mean treating them all the same. If a large customer simply wants undifferentiated products at the lowest price, does that really demand a close relationship? Should the firm allocate sales and service efforts to serving that type of customer? Probably not. The article points to five segments in the customer portfolio to consider.

The price is right

The price is right customer is very transactional. There is little value to be co-created. If the firm is currently serving this customer by focusing on the transactional relationship, it likely means offering a product or limited service at a set price. This relationship looks like many in the economist’s free market. It leverages an agricultural retailer’s ability to manage logistics well. It might not be very challenging or satisfying for the salesforce because it reduces their role to order taker. The firm can be profitable on the transactions, though.

Grow the pie

The grow the pie customer is the MVP in the portfolio. There are many opportunities to co-create value and partnering makes sense. The benefits are likely to accrue over many years and growing seasons. As the authors suggest, it is incumbent on the retailer not to take this relationship for granted. It will remain useful to document the mutual benefit that accrues to both parties.

Test the waters

The authors suggest two reasons for customer relationships in this segment—middling scores on all the questions or extreme scores cancel each other out. If there are middling scores all around, the ag retailer has some serious gut check about how this relationship should unfold in the future. Managers should consider investing resources if the relationship has room to grow to mutual benefit. If not, the retailer should pull back and consider moving to a more transaction relationship—even for some of the add-on product and service offerings.

If it is the case that extreme scores are canceling each other out, it is likely a few critical reasons are driving the result. For example, one diagnostic question is around the technological uncertainty in the industry. Given the uncertainty around precision agriculture, it seems likely that ag retailers need to clarify their role and stress advantages of partnering at every juncture.

One reason for this score could be unique to agriculture. As farms undergo transitions in ownership and decision-making, an increasing number of customer relationships could spend time in this in between stage. Perhaps the farm customer had been in the “Grow the pie” category. Under new ownership and decision-making, perhaps the farm customer has eased back towards transactional relationships. This merits the same actions suggested in the article: stress reasons for collaboration, focus on issues and soothe fears.

Necessary enlightenment

If there really exists value in partnering and the retailer isn’t currently meeting it, then there needs to be corrective action. The salesperson might consider approaching this customer with a fresh take. Dr. Scott Downey, Purdue associate professor of agricultural economics, suggests using a discovery process to dig deeper to understand customer’s needs, wants, motivations and success measures. Then the retail team can go back to the drawing board to brainstorm opportunities. Finally, a plan to communicate the opportunities and benefits could move the relationship toward “Grow the pie.”

Rose-colored glasses

It seems likely that a brutally honest assessment will be the only way a retailer identifies customers in this segment. We want to assume we can collaborate on creating value. Thus, it will take a very honest group to admit that a current top customer really is not benefitting from collaboration. If you find a customer in this area, the authors offer the best advice: Enjoy it while it lasts.

This is one more means for assessing your customer portfolio. Given the dynamic agricultural environment, it might just be time for this new framework.

RELATED POSTS:

A great moment for value-based sales in agribusiness

Value-based sales can empower companies to craft compelling value propositions, understand the customer’s business model and effectively communicate to stakeholders.

How can big data empower the development of new products?

Data is one of the most powerful resources for a company. It enables accurate decision-making and minimizes risk, ensuring greater revenue and sustainable growth.

Unlocking Growth: Exploring innovation dynamics in the agrifood sector

The future for the agrifood sector appears promising, driven by technological advances, strategic M&A activity and a growing commitment to innovation.