Customer orientation and organizational performance

Article

Article

Ruud T. Frambach, Peer C. Fiss, and Paul T.M. Ingenbleek. “How Important is Customer Orientation for Firm Performance? A Fuzzy Set Analysis of Orientations, Strategies and Environments.” Journal of Business Research, 69 (2015): 1428-1436.

Reviewer

Dr. Michael Gunderson, Director and Professor

Summary

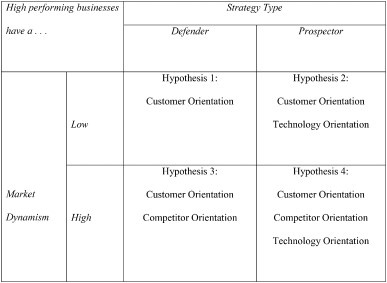

The authors of the article focused on understanding which orientation (customer, competitor or technology) or combination of those is best depending on the firm’s strategy (defender versus prospector) and market dynamism (low versus high). The authors concluded that customer orientation is the base orientation regardless of strategy or market dynamism. The benefits of customer orientation are more fully leveraged when combined with orientations depending on the firm’s strategy and market’s dynamism.

For the firm’s strategy, the researchers classified the firms as “prospectors” (the firm actively and aggressively innovates new services and products) versus “defenders” (the firm is comfortable in its current product and service offerings and does not seek new opportunities). There is also a set of “analyzers” that operate between prospector and defender, but tend to behave like one or the other. For market dynamism, the research characterizes industries as either stable or dynamic. Customer orientation needs to be complemented with a technology orientation for firms pursuing a prospector strategy. Customer orientation needs to be complemented with a competitor orientation for highly dynamic markets.

Figure 1. The Hypothesized relationships among firm orientation, firm strategy, market dynamism and firm performance.

Figure 1. The Hypothesized relationships among firm orientation, firm strategy, market dynamism and firm performance.

The authors included a discussion regarding the quantitative methods employed in the article. The only reason to note this here is that the title includes “fuzzy set analysis.” One might interpret that phrase to mean the analysis was less rigorous, accurate or precise than other quantitative methods such as regression analysis or structural equations modeling. As the authors note, the method is quite rigorous and precise and is more likely to yield accurate results in this research project.

What this means for food and agricultural businesses

I was drawn to this article because the title suggested that customer orientation could be anything other than beneficial for firm performance. Agribusinesses, that is, firms that supply inputs to agricultural producers, tend to be focused intensely on delivering products and services for farmer customers. What about the firms operating in the food value chain closer to the consumer? These firms are intensely focused on consumers. Could firms in the food and agricultural business industries have it all wrong?

The answer to the question in the title of the article, “How important is customer orientation for firm performance?” is simply: very important. I would suggest to improve clarity the authors retitle the article, “How best can firms fully leverage a customer orientation for maximum performance?” Then again, maybe I wouldn’t have been so intensely drawn to the article. The additional orientations (competitor and technology) depend on the firm’s strategy and the market dynamism.

I suspect most would characterize the entire food value chain and its industries as stable. Thus, market dynamism is low (Figure 1) and how best to leverage a customer orientation is likely to depend on strategy. If the firm’s strategy is to defend its current market position, then there is no orientation that will complement customer orientation. If the firm’s strategy is prospect for new opportunities, then successful firms will complement the customer orientation with a technology orientation. Note, the analysis allows for high performing businesses to exist as both defenders and prospectors. It is possible to be an innovator as well as a close follower.

Is there a fourth orientation that is relevant for food and agricultural firms? Namely an inwardly focused, operational orientation. Particularly in the retail parts of the value chain, it seems likely this is an important orientation. Whether it be grocery retail or agricultural retail, in stable markets, a customer orientation might best be leveraged and achieved by an intense operational orientation that leads to cost leadership. In many regards, this is exactly what a commodity-based production and distribution system is meant to achieve. If customers’ needs and wants are completely standardized (think #2 yellow corn), then customer orientation becomes irrelevant. Only cost leadership matters. Did agribusiness firms compete similarly when farmer customers’ needs and wants were relatively the same?

Because the authors focused on bringing new technology to the customer, the intense adoption of improved technology in food processing is excluded in the technology orientation. Food processors, however, have adopted technology as it relates to an operational orientation. By reducing the cost per box of cereal through more efficient equipment, the processors pass along cost savings while holding customer satisfaction with quality constant.

As the importance of employee talent in achieving high performance grows, firms might consider an operational orientation to be an employee orientation. That is, employee-oriented firms would work to maximize the ability of employees to deliver value to a customer with existing physical resources. This relates back to my first quarterly review article, where all employees are responsible for strong brands. They are likely to be responsible for delivering on customer orientation and firm performance.

RELATED POSTS:

A great moment for value-based sales in agribusiness

Value-based sales can empower companies to craft compelling value propositions, understand the customer’s business model and effectively communicate to stakeholders.

How can big data empower the development of new products?

Data is one of the most powerful resources for a company. It enables accurate decision-making and minimizes risk, ensuring greater revenue and sustainable growth.

Unlocking Growth: Exploring innovation dynamics in the agrifood sector

The future for the agrifood sector appears promising, driven by technological advances, strategic M&A activity and a growing commitment to innovation.