Written by

John Foltz, Professor Emeritus, The Ohio State University; and Dean Emeritus, College of Agricultural and Life Sciences, and Professor Emeritus, Agricultural Economics, University of Idaho

Lance Woodbury, Principal, Pinion (formerly KCoe Isom, LLP)

Jay Akridge, Trustee Chair, Teaching and Learning Excellence and Professor, Department of Agricultural Economics, Purdue University

Many closely held or family businesses make the decision to incorporate for the positive benefits provided by a corporate legal structure. These benefits include corporate personal liability limits and the potential for a corporation to survive the departure of a principal member of the business due to their decision to leave the business or their death. One of the requirements for incorporation in many states is the establishment of a board of directors.

Some owners of closely held companies view incorporating as unnecessary and overreaching. These companies may have a “compliance” board that fulfills legal requirements but has little input in strategic business decisions. While a compliance board may give the owner a greater sense of control, it also has downsides. As Harvard University professor Noam Wasserman describes in his book The Founder’s Dilemmas, “Most entrepreneurs want to make a lot of money and to run the show.” Wasserman’s research indicates, “It’s tough to do both. If you don’t figure out which matters most to you, you could end up being neither rich nor king.”

This publication delves into the composition of boards of directors—how the right board members can benefit closely held farm and agricultural corporations.

The Founder's Dilemmas

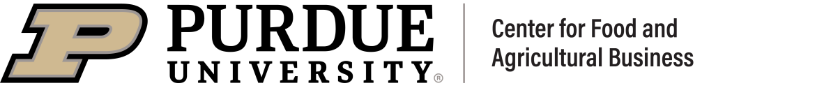

In The Founder’s Dilemmas: Anticipating and Avoiding the Pitfalls That Can Sink a Startup, Wasserman states that entrepreneurs “face a choice between making money and controlling their business. And each choice comes with a trade-off” (Table 1).

This publication focuses on the board of directors: the role it will play and who serves on the board. According to Wasserman, decisions about the board are heavily dependent on the ambitions and goals of the founder/owner of the farm or agricultural business.

Types of Boards

Edward Robson of Robson and Robson, a Pennsylvania law firm, writes about types of boards in his blog Prepare to Be Boarded! Robson’s key types of boards are outlined below.

Compliance Board

At one end of the continuum is the compliance board. A compliance board is a nonfunctional board meant to meet legal requirements. In fact, it may comprise only the owner(s) of the closely held business. Nonfunctional means the board has no material influence on the decisions of the organization and exists to satisfy legal requirements.

Insider Board

One step away from a compliance board, and as Robson states, “toward a functioning board,” is the insider board. This type of board may be established by the founder but is designed to involve the family and senior management in big-picture planning. However, the owner(s) retain ultimate decision-making authority.

Inner Circle Board

Moving closer toward a more independent board, the inner circle board contains directors the founder(s)/owner(s) know well but who bring perspective and knowledge that is different from, and beyond that, of the owner. This type of board can provide important guidance on growth and profitability, as well as other strategic issues—and perhaps challenges the thinking of the owner(s)—but the owner retains the authority to make decisions.

Independent Board

With this type of structure, outside/independent directors have no tie (employment, familial, or otherwise) to the company aside from their role as directors. The goal for these directors is to be more objective and less deferential to ownership than members of the previous types of boards. They expect their input to be considered and acted upon, and the owner(s) may not retain full decision-making authority as they would with the other board structures.

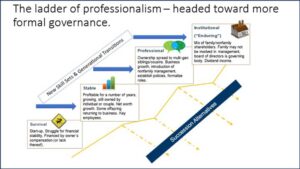

The Case for the Independent Board

Pinion, LLC, a food and agricultural consulting firm, has developed a “ladder of professionalism” of the closely held firm that outlines a range from “survival” to “institutional.” This ladder describes a firm’s growth towards more formal governance as it adds new skill sets as well as plans for generational transitions (Figure 1). From an initial start-up where the farm or agricultural business focuses on survival and securing financial stability, the firm progresses to stability and growth in net worth. Pinion describes the next stage beyond stability as a move to a more professional business, where nonfamily management, policies, and formalized roles are introduced. The ladder culminates in an institutional business with a potential mix of family and nonfamily shareholders, the addition of outside managers, a board of directors as a governing body, and the board’s duty to hire and evaluate a CEO (who may or may not be the founder of the business).

Where is Your Farm Business on the "Family Business Continuum?"

An important point for consideration is where the family/closely held corporation sees itself in terms of emotion versus logic. Closely held family businesses can span two ends of a business continuum (Figure 2). At one end of this continuum is the choice of the family to focus more on the emotional or “family-oriented” nature of the business. This type of business might allow family members to join and/or remain in the business even if their performance would be characterized as “poor” or “needs improvement” by an impartial observer. Other traits might be “making room” for children, nieces, or nephews whose addition places strains on cash flow or profitability. The overarching point is that emotion and/or familial ties weigh heavily on the firm’s goals and decisions.

Figure 2 (click graphic to view enlarged image). The Family Business Continuum. Source: Pinion, LLC.

At the other end of the continuum are “business-oriented” firms whose primary approach is to make logic-based, rational decisions. This type of firm focuses on achieving key performance indicators (KPIs), maximizing profitability, and achieving strategic goals—family considerations have much less impact on decisions.

While most family businesses are not on one end or the other, the continuum helps a manager/owner reflect on the general weight that emotion and logic play in the firm’s decision-making processes. In reality, almost all firms operate somewhere between these two extremes. However, if your closely held business has grown in size (measured by sales, profitability, assets, and number of employees, among other measures) and complexity, it may be time to consider a more professional governance structure. Such a decision is heavily dependent on some degree of consensus among key family or business members as they explore a more professional approach to business governance. Some key points to consider and ways to start this process are outlined below.

The Benefits of an Independent Board of Directors

Robson states, “Good business decisions can’t be based on fleeting passions and grievances. They should be grounded in a rational and impersonal assessment of the situation. An (independent) board can help ensure that such an assessment is the norm.” This is good advice but it is typically easier said than done within the confines of the closely held farm or agricultural business. “One can’t flip a switch and instantly separate business from emotion,” says Robson. “But a Board of Directors is tremendously helpful in creating that separation. A healthy separation between closely held companies and their owners reminds owners they are not their companies, and vice versa.”

Another important reason to consider an outside board is that it broadens the firm’s access to expertise. It’s important to ask a number of questions to achieve this goal. What are the areas of the business/industry where family members excel? What are the expertise gaps that external directors could fill? Can someone with deep financial insights add value? Or is there someone with extensive technical knowledge, or policy/regulatory knowledge, or just someone who ‘knows business’ in an entirely different industry that can offer expertise? Diverse perspectives provide a rich base of insights to draw from as the firm sets its strategy for the future.

Some farm and agricultural business owners may still have doubts and perceive the drawbacks of installing an independent board. With proper planning many concerns can be addressed, but a competent attorney or a consultant with expertise in this area should be engaged. According to Robson, owners who fear giving up control of their business can maintain control as long as they are the controlling shareholders. Owners who are afraid of sharing confidential information with an independent board can have directors sign nondisclosure agreements. Owners who fear they’re going to have to waste time on the formalities of having a board can bring in a co-worker to compile agendas and materials and take meeting notes. According to Robson, owners who fear they’d have to waste money on compensating directors can provide equity (rather than cash compensation) to their directors—and hopefully the directors create the kind of value that dwarfs their compensation.

If a fully independent board is a step too far for a closely held family business, the firm can add an independent director/advisor to their family board and obtain at least some of the benefits of an independent board. This individual can be selected based on the specific expertise they would bring to the firm. It is also important to develop a set of expectations for an independent director/advisor:

- What role do you want them to play?

- How much time are they expected to spend?

- What authority, if any, do they have in decision processes?

These individuals can serve in the role of an outside advisor, providing insight into areas not well addressed by family board members. And, in some cases, it is possible this will be a reciprocal relationship—the individual can serve as the owner’s outside adviser if the owner serve as theirs. This external board member/adviser may provide a more palatable alternative to an independent board and could also serve as a first step toward such a board, allowing the family to evaluate the benefits and costs of an outside, independent board.

Food for Thought—and Possible Action

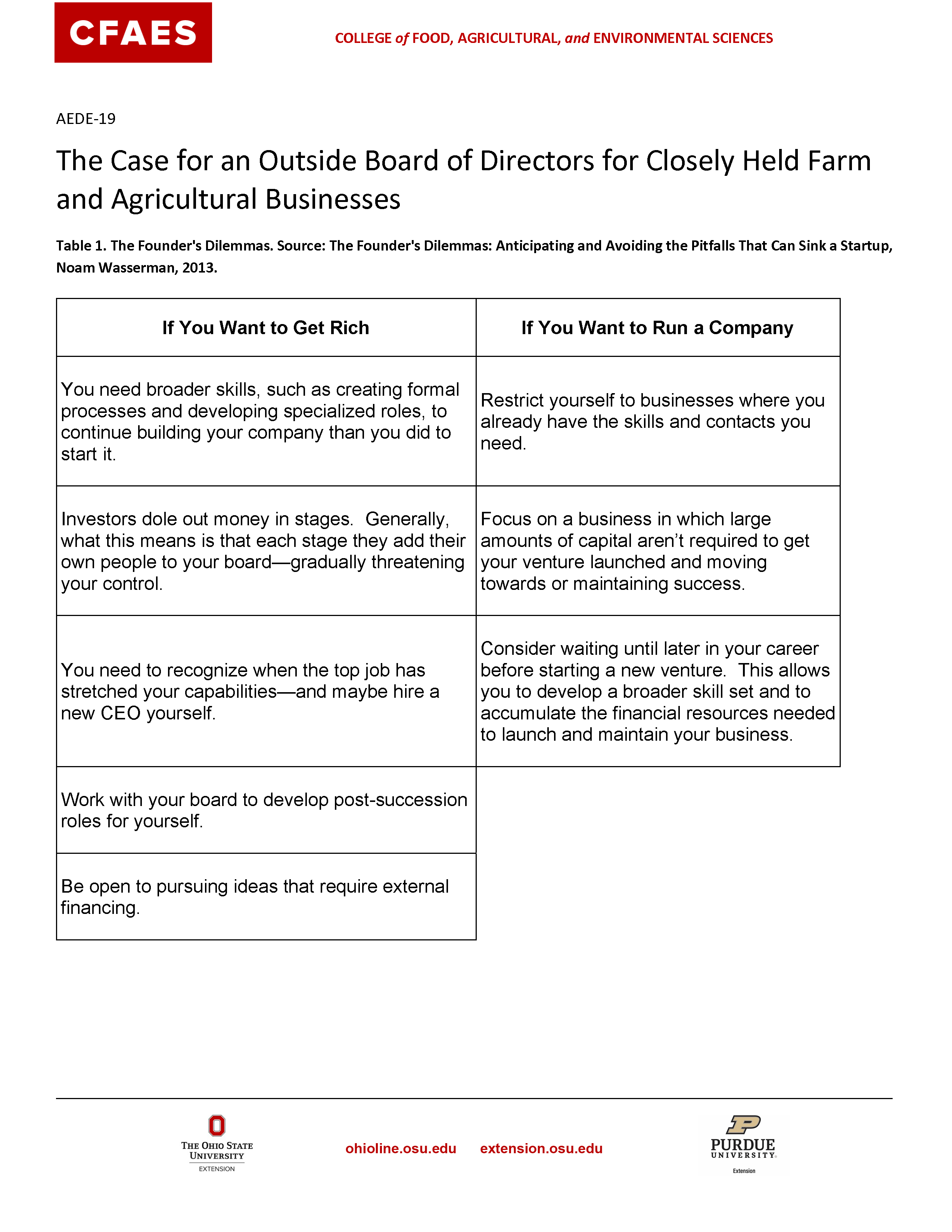

The adoption of an independent board is not a decision to be undertaken without thoughtful discussion and assent from most or all members of a closely held corporation. However, the benefits to the firm that have been reviewed provide “food for thought,” and possible action. Action to move in this direction includes discussion of the topic among the members and owners of a firm. Many closely held/family-based farm businesses find that a consultant can assist in these challenging discussions. If the decision is to move in this direction, then it is also important to work with an attorney well-versed in these types of dealings. A checklist is provided below that may prove helpful in this decision process.

In the end, ask yourself if your farm or agricultural business can benefit from “hybrid vigor,” the scientific principle that the offspring of genetically different parents (in this case, the owners and the independent board members) exhibit increased vigor, yield, and general health, which translates to improved business growth and profitability.

Some of the ideas and thoughts in this publication were generated at a Table Talk held at the Farm Foundation Roundtable meetings in Kona, Hawaii on January 19, 2024. The authors also appreciate the review provided by Duane Grant of Grant 4-D Farms in Rupert, Idaho. Portions of this publication were originally published by WATT Global Media in Feed and Grain Magazine at feedandgrain.com/15669768.

In partnership with Ohio State University Extension.