From Dr. Widmar:

I became infatuated with the idea of cultivating my own online media datasets after gleaning insights from attending the Disney Data and Analytics Conferences (DDAC) in 2017 and 2018. Having long worked with survey data in agricultural and food industries for my research program, I wanted to expand capabilities to analyze and derive insights from other data sources. In online media data I found an entire field of work progressing rapidly in a variety of industries, but largely lacking within agricultural industries. In truth, most social and online media analytics happen at the brand or company level, rather than being framed in pragmatic research-oriented projects for public consumption. The return on investment (ROI) is much harder to envision for public goods, commodity products, and/or ‘basic’ topics for research in this online space. This dearth is precisely where I saw my own potential contributions … to fill this very void.

I came home from DDAC in August of 2017 and told my then PhD student at Purdue University (Boiler Up!), now Assistant Professor at Oklahoma State University (Go Pokes!), Dr. Courtney Bir that we were going to scrape online media data ourselves. Courtney was (correctly) concerned, but never one to shy away from a challenge. Having been handed one massive puzzle with no warning and no instruction manual, she got to work tackling how we would do this ourselves. The goal was to maintain control of the search/scrape process to ensure data quality to a level that would confer confidence for academic publication. What transpired between then and now was a three-year flurry of a variety of new skill development sessions, a last-minute red-eye flight to L.A. for Courtney to get some training from Netbase when I got both of us in way over our heads to a level no phone call or Zoom session could fix, and a steep learning curve for two agricultural economists navigating social media analytics.

It took three years to generate research in this vein of work of the caliber to publish and promote. In 2018, I shared ‘sneak previews’ into what the vision for social media analytics work was developing into in the Widmar Research Group in Purdue AgEcon at the 2018 Dawn or Doom Conference. In the past 90 days, the first of many of these works still in progress have found their way into the public domain, including: the public sentiment surrounding the move of the United States Department of Agriculture to Kansas City (out of Washington, D.C.), public sentiment towards veterinarians in the US, and investigating whether sentiment is related to performance measures for iconic theme park destinations. This article focuses on the third of these papers — the one in which we sought to determine if our in-research-group constructed social media sentiment scores were related to performance by traditional measures.

The article cited in and inspiring this article by Widmar and Bir, appearing in Consumer Corner in the Center for Food and Agricultural Business, can be found at:

Widmar, N., C. Bir, M. Clifford, and N. Slipchenko. 2020. “Social media sentiment as an additional performance measure? Examples from iconic theme park destinations.” Journal of Retailing and Consumer Services. 56. https://doi.org/10.1016/j.jretconser.2020.102157

Is Online Media Sentiment a Performance Measure You Should Consider?

By Dr. Nicole Olynk Widmar, Associate Head and Professor, Department of Agricultural Economics, Purdue University & Dr. Courtney Bir, Department of Agricultural Economics, Oklahoma State University

As states around the U.S. navigate stages and phases of reopening from COVID-19 shutdowns and nations around the world work to navigate returns to normalcy, one cannot deny the role that being (or not being!) ONLINE has played in recent months. Internet access has afforded people access to work, school, media for entertainment and information/knowledge, medical care from a distance via telemedicine and perhaps most importantly for our own human selves, access to one another. Family dinners via Zoom became widespread over the past 90 days, whereas prior to quarantine, many toddlers had not yet considered the role of online conference software in their family lives.

Businesses, including agricultural and food businesses, are online. Websites, social media accounts, apps for in-field use and basic communication needs between our employees take place via the World Wide Web every day. Even our agricultural industry which lacks relative connectivity due to remote locations and rural Internet service is reliant on its online presence and existence on the web.

Introducing Online/Social Media Data Analytics & Performance Metrics

There has been significant progress in understanding our online presence being moved forward with computer programming, marketing, analytics and business management expertise all contributing. Sentiment analysis using social and online media derived data offers the potential to transform online qualitative data into a numeric score.[1] Once sentiment, as a numeric value, can be assigned using a variety of techniques and algorithms to score language (commonly referenced as Natural Language Processing), that numeric value can be compared to existing performance metrics such as stock prices[2],[3], with past work having found that sentiment is most useful when accuracy of price-only prediction models is low.[4]

Case Study Example: The Iconic Walt Disney World Resort Vacation Destination, Orlando, FL

Our recent work, “Social media sentiment as an additional performance measure? Examples from iconic theme park destinations”, published in the Journal of Retailing and Consumer Services uses online media data for two iconic theme park destinations — Disney World and SeaWorld — to investigate the potential for relationships between known performance measures, such as stock price and crowd scores (as a proxy for number of visitors) and social media sentiment scores. Disney World offers more opportunity for depth of study due to the sprawling nature of Disney World, Orlando, FL with its 25 resort hotels, four main parks, two water parks and multitude of attractions and restaurants within.

“The nature of the multi-park and numerous resort complex of Walt Disney World allowed for more in-depth data analysis by differentiating resorts by Disney-defined classifications as well as delineating data by mention of specific parks (or attractions within that park). Social media mentions of individual parks were measured for the four ticketed parks (excluding waterparks) of Disney’s Animal Kingdom®, Epcot®, Magic Kingdom®, and Hollywood Studios®. Resorts were grouped according to their classifications as outlined on the Walt Disney World resort main website of deluxe, moderate, or value (Disney World, 2018). In total, in addition to the general Walt Disney World terms, seven subcategories were developed consisting of the four parks named above and the three categories of resorts, grouped by the Disney-provided classifications.”[5]

Summary of Findings

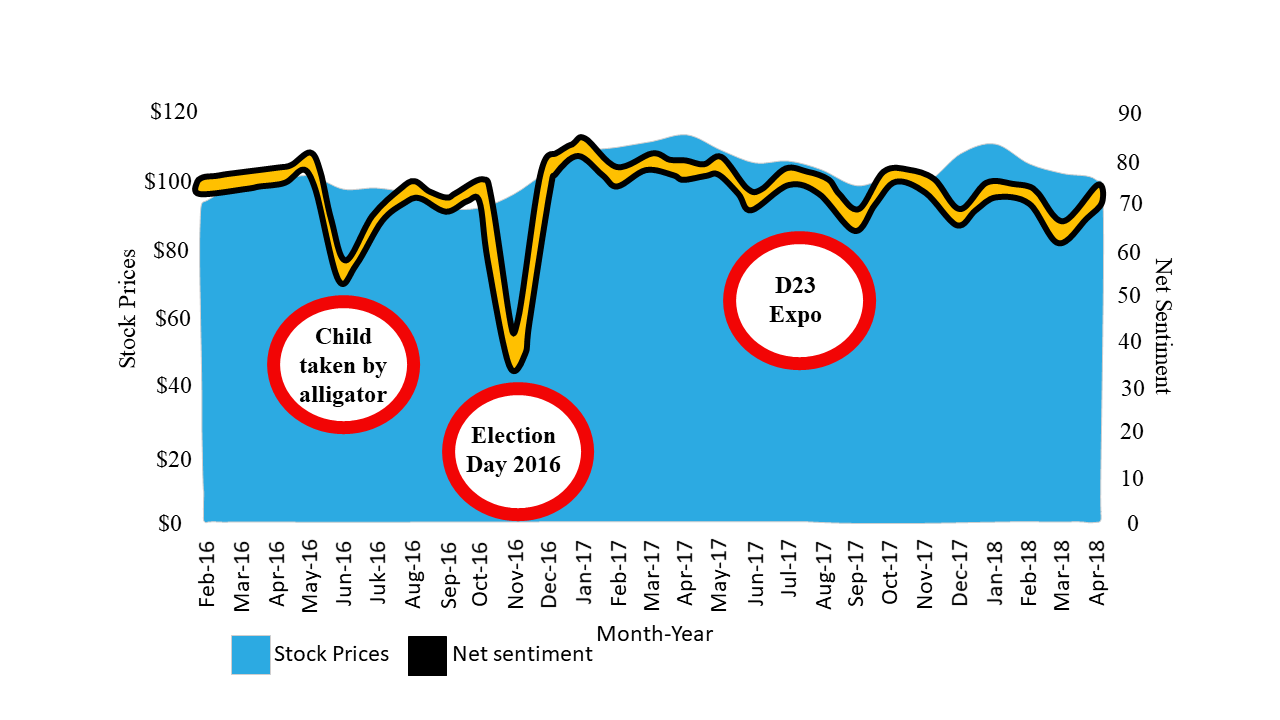

“To discern if the net sentiment developed in this analysis is related to other datasets commonly representing performance of Disney World and SeaWorld, correlations between closing stock prices and net sentiment were estimated.” The bottom line is that we found some evidence of correlation between social media sentiment as we constructed it about Disney World and stock prices over the same time period. The figure below details closing monthly averaged stock prices and net social media sentiment for Disney World. Net sentiment movements can be easily visualized with the single largest fall being attributable to coverage about Florida (and mentioning whether the state was ‘deserving’ of Disney World or not) related to the 2016 election. The second largest decline was understandably in response to the tragic loss of life of a young child to an alligator on the banks of the famous Lagoon at a Disney resort near Magic Kingdom.

Pearson correlation coefficients revealed a statistically significant correlation of 0.3785 in our Disney World data (p-value of 0.0515) between the monthly net sentiment value and the same month’s average closing stock price. SeaWorld’s data and equivalent analysis is presented in the source article, but we failed to find a significant relationship between stock prices and social media sentiment.

In Summary …

Past works have found evidence of relationships between stock prices and social media sentiment. Our recent publication found mixed evidence of a relationship between traditional performance data (using stock prices) and social media sentiment data. It is possible that sentiment and stock price are more closely linked for some companies, industries or brands than others. Perhaps our selection of the iconic Walt Disney World as a case study was too much considering its extremely high familiarity with consumers and the general public, thus resulting in a higher number of mentions and posts compared to a more local brand or product rather than physical destination.

How you are perceived and what people believe about you impacts your business. Any number of hypotheses and possible explanations can be posited for our findings and those of others in this online media and public perceptions space. Yet, the fact remains that companies, brands, industries and perhaps even concepts/ideas take on ‘life’ online which cannot be completely ignored. While the ‘how’ to use online media data is admittedly still debatable, the need to be ‘in the know’ regarding how media impacts our businesses is real for agricultural and food industries. In fact, with recent movement of so much of our lives online with COVID-19 keeping people distanced, our online selves may be more important than ever.

ConsumerCorner.2020.Article.01

The article cited in and inspiring this article by Widmar and Bir, appearing in Consumer Corner in the Center for Food and Agricultural Business, can be found at:

Widmar, N., C. Bir, M. Clifford, and N. Slipchenko. 2020. “Social media sentiment as an additional performance measure? Examples from iconic theme park destinations.” Journal of Retailing and Consumer Services. 56. https://doi.org/10.1016/j.jretconser.2020.102157

Footnotes

[1]M. Thelwall, K. Buckley, G. Paltoglou. Sentiment in twitter events. J. Am. Soc. Inf. Sci. Technol., 62 (2) (2011), pp. 406-418

[2] D.A. Schweidel, W.W. Moe. Listening in on social media: a joint model of sentiment and venue format choice. J. Mar. Res., 51 (4) (2014), pp. 387-402

[3] S. Tirunillai, G.J. Tellis. Does chatter really matter? Dynamics of user-generated content and stock performance. Mar. Sci., 31 (2) (2012), pp. 198-215

[4] T.H. Nguyen, K. Shirai, J. Velcin. Sentiment analysis on social media for stock movement prediction

Expert Syst. Appl., 42 (24) (2015), pp. 9603-9611

[5] Widmar, N., C. Bir, M. Clifford, and N. Slipchenko. 2020. Social media sentiment as an additional performance measure? Examples from iconic theme park destinations. J. of Retail Consum Serv. 56. https://doi.org/10.1016/j.jretconser.2020.102157

Source Article Author Information

Courtney Bir

Assistant Professor

Department of Agricultural Economics

Oklahoma State University

* Courtney completed her PhD in the Department of Agricultural Economics at Purdue University in December 2019.

Nicole Olynk Widmar

Professor, Associate Head and Graduate Program Chair

Department of Agricultural Economics

Purdue University

nwidmar@purdue.edu

McKenna Clifford

Masters Student

Department of Agricultural, Food and Resource Economics

Michigan State University

* McKenna Clifford completed her bachelor’s degree in Agribusiness Management at Purdue University in 2018.

Natalya Slipchenko

Masters Student

Department of Agricultural and Resource Economics

University of California, Davis

* Natalya Slipchenko completed her bachelor’s degree in Agribusiness and in Animal Science at Purdue University in 2019.