Author: Nicole Olynk Widmar, Associate Head and Professor, Purdue University, Department of Agricultural Economics

U.S. meat markets got quite the spotlight during the pandemic-era. A full-page ad in the Sunday New York Times by the Tyson Foods board chairman John Tyson in April 2020 entitled, “The Food Supply Chain is Breaking” elicited national concern and corresponding media response. Tyne Morgan followed up with a piece aptly entitled, Is the Food Supply Chain Actually Breaking?, in which she conducted an interview with Dr. Jayson Lusk.

“I have a little different view,” says Jayson Lusk, a Purdue University agricultural economist. “I think by and large, throughout this crisis, the food supply chain has responded remarkably well. Yes, we had a short period where some grocery store shelves were empty, but by and large, food was available. It might have been a different variety or different brand than you’re accustomed to buying. But the foods system responded remarkably well to a completely unexpected and unprecedented event. We certainly have some very serious challenges coming up in the meat sector, but that doesn’t mean the entire system is broken.”

Inspired by this debate, we (myself, along with Dr. Courtney Bir, Dr. Nathanael Thompson, and Purdue Ag Econ PhD student Eugene Kwaku Mawutor Nuworsu) embarked on a research project dedicated to understanding both the media attention to and the realities of U.S. meat market functionality during 2019 and 2020. The result of that effort is a recent publication in the journal Meat Science, entitled, Perception versus reality of the COVID-19 pandemic in U.S. meat markets, which is freely available for download here: https://authors.elsevier.com/a/1ey2r16J4lmL2e any time before June 10, 2022.

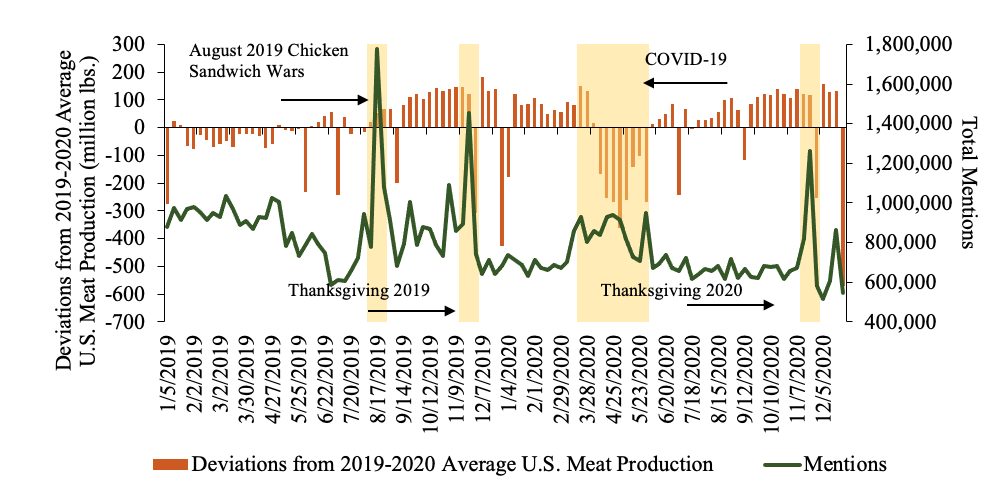

The reality is that meat production in the U.S. did decline during the pandemic. The total meat production in April and May 2020 was 1.5 billion lbs. (10%) less than same time frame during 2019. Indeed, there was an uptick in total media mentions about meat during this time period, but nowhere near as high a spike as we saw in the August 2019 chicken sandwich wars, or during the Thanksgiving holidays (when turkey is discussed abundantly).

A version of this image appeared as Figure 1 in Perception versus reality of the COVID-19 pandemic in U.S. meat markets.

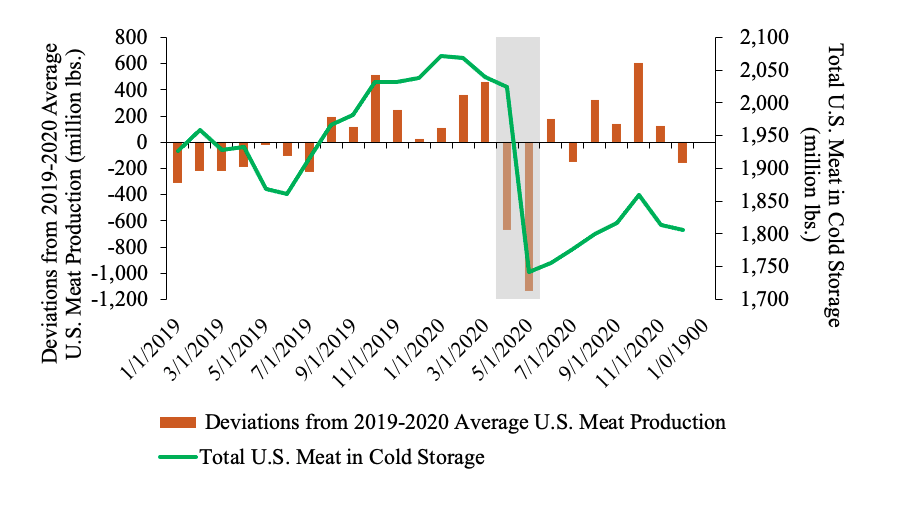

But did this cause an actual shortage? No, there wasn’t a shortage. “The notable decrease in meat production in April and May 2020 did not yield a shortage in the U.S. marketplace due to the ample stocks of meat in cold storage which were drawn down during this time period of decreased production.”

A version of this image appeared as Figure 3 in Perception versus reality of the COVID-19 pandemic in U.S. meat markets.

Thus, while there was a notable fall in meat production in April and May of 2020, there was a rebound by the first week of June 2020 – and – drawing down of meat in cold storage.

Admittedly, there were times when an individual consumer may not have been able to find exactly the cut of meat they wanted on the day they wanted it, but meat overall was still readily available. Net sentiment in online media searches did decline notably in the early days of the pandemic, although there were also reactions to non-COVID events uncovered during this time period and the net sentiment remained positive (24) on the scale of -100 to +100.

Additional details and figures delving into online media and public sentiment can be found in the full-length publication: https://authors.elsevier.com/a/1ey2r16J4lmL2e.

Taken all together, the authors summarize by saying, “Despite the ongoing conversations about the pandemic revealing vulnerability in the meat supply chain, a direct comparison between perception and reality reveals that total meat production in the U.S. showed resiliency and efficient recovery after the April and May 2020 declines due to COVID-19—in this case, perception did reflect reality. Therefore, calls to create redundancies in the meat supply chain through disaggregation or local, direct-to-consumer marketing channels, while intuitively appealing, are not a panacea and lack rationale (Hobbs, 2021; Lusk et al., 2020; Ma & Lusk, 2021).”

- Hobbs

The COVID-19 pandemic and meat supply chains

Meat Science, 108459 (2021)

J.L. Lusk, G.T. Tonsor, L.L. Schulz

Beef and pork marketing margins and price spreads during COVID-19

Applied Economic Perspectives and Policy, 43 (2020), pp. 4-23

- Ma, J.L. Lusk

Concentration and resiliency in the U.S. meat supply chains

Working paper. Available online

(accessed May 27. 2021)

ConsumerCorner.2022.Letter.15