We at Purdue University are proud to have partnered with Indiana Grown to receive a grant through the USDA’s Federal State Marketing Improvement Program to study the economic impacts of the program for agricultural producers and agricultural supply chains in Indiana. Here at Consumer Corner, our team’s component of this project was to develop a broad understanding of how Indiana residents perceive Indiana agricultural products, what they seek out in their own shopping trips and ultimately to understand consumer demand for Indiana Grown products. Taylor Thompson (MS student in Purdue Agricultural Economics) kicked us off with the top items Indiana residents seek out locally. Benjamin Ellman (BA student in Economics at Vanderbilt University; Summer research intern in Purdue Agricultural Economics) then walked us through what’s stopping us from buying local. Now, they’re back to look at the importance of various factors when purchasing local products.

~ Dr. Nicole Widmar

Author: Ben Ellman, BA Student, College of Arts & Sciences, Vanderbilt University

Taylor Thompson, MS Student, Purdue University Department of Agricultural Economics

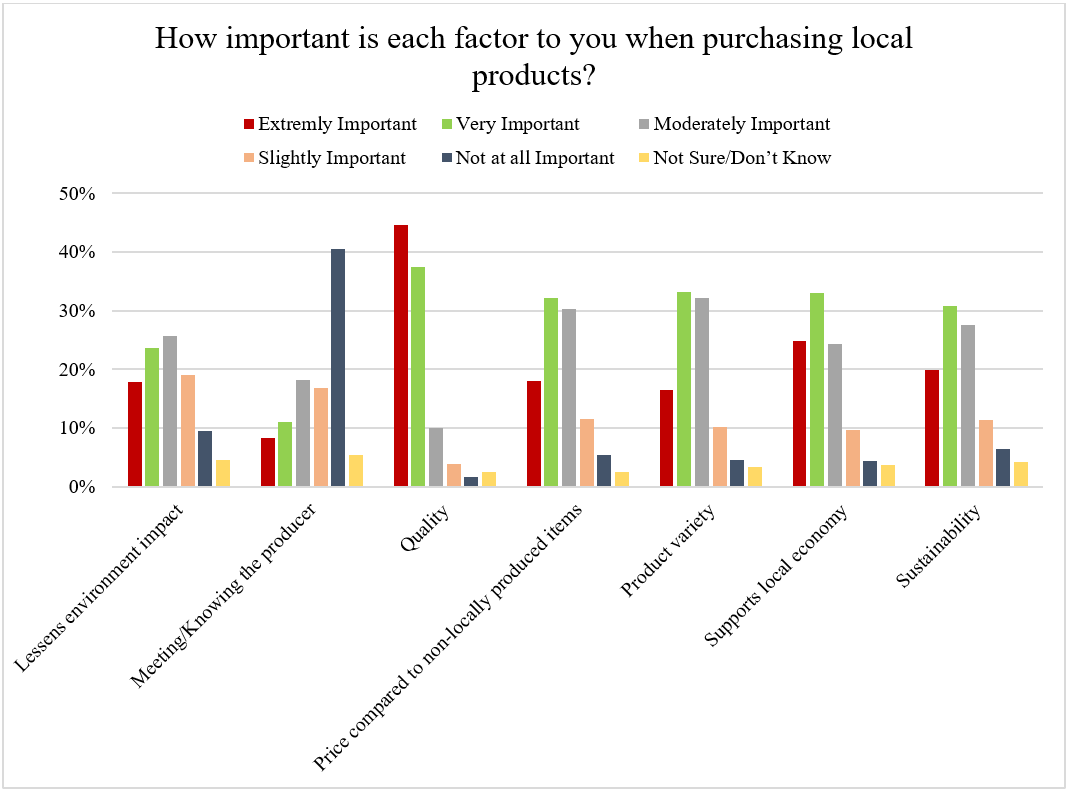

Consumers purchase local food products for a variety of reasons. We asked 484 Indiana residents “How important is each factor to you when purchasing local products?”. Respondents were asked to indicate whether each of the seven provided factors were “Extremely important”, “Very important”, “Moderately important”, “Slightly important”, “Not at all important”, or “Not sure/don’t know”.

Respondents were not forced to make tradeoffs among these factors, but instead could rank each factor independently. Therefore, every factor could be rated as “extremely important” by a single respondent. As expected, since tradeoffs were not forced and respondents could place importance on a variety of factors, the most common responses were “very important” or “moderately important” for most factors studied; however, two factors stand out as differing from this trend — Quality and Meeting/Knowing the Producer.

Of the provided factors, survey respondents overwhelmingly indicated that Quality was the most important reason for purchasing local food products, with only 4% of respondents indicating it was either “not important” or they were “not sure”. Over 80% of those surveyed selected quality as “extremely important” or “very important”. For comparison, the next most important factor for buying local products is Supporting the local economy, with 58% of respondents indicating it was “extremely important” or “very important”.

The data suggests that consumers differentiate on quality; appearance, taste, smell and other attributes likely all play roles in perceptions of quality. While the results suggest Quality is the single most highly-rated factor, more research is needed on other product types that may carry varying associations and expectations for consumers as these may influence how consumers perceive the importance of these factors for local products. For example, a browsing consumer may value attributes of quality differently depending on the desired product, influencing how they choose between certain local and non-local goods. Whether consumers truly associate local products with higher quality likely depends on product type, but still requires further examination.

Roughly 40% of respondents viewed Meeting/Knowing the Producer as “not at all important”. For some, this is just an outcome of the current market structure in which a complicated supply chain takes products from the farm gate, transforms them and delivers them to consumers sometimes half a world away. For others, this may come as a surprise. One possible question for further investigation is the area in which respondents live. More urban regions tend to have less ease of interaction or direct access to producers. Survey respondents from the densest population regions more often reported lesser importance of knowing the producer. While location may account for some of the reason for this surprising response, further analyses are needed regarding this possibility and other explanations. Additional demographic factors such as age, buying preferences for products regularly, and household income brackets rated higher versus lower importance in Meeting/knowing the producer will be studied in our continuing analyses.

Agriculture is a way of life for many. Without a doubt, it has, and rightfully so, an emotional attachment for producers. But what about in terms of the overall global market? Simply put, consumers see products before we see those who work to provide them. What’s another example of this? Let’s take a trip back to high school economics class. The creation of a pencil is commonly taught when describing global markets; an everyday item brought to us from all over the world. Similar practices take place across various industries, and it’s commonplace for the consumer. The line of thought simply seems to be, “I desire a quality product.” That’s not a knock on those working hard in the industry, but merely something to acknowledge as part of our collective understanding in ‘what consumers want’ as we shape communications and marketing efforts in our diverse and varied agricultural and food markets.

ConsumerCorner.2021.Letter.23