With harvest under way across most of the Corn Belt, agricultural producers and suppliers will begin planning and preparing for 2017.

With harvest under way across most of the Corn Belt, agricultural producers and suppliers will begin planning and preparing for 2017.

While many producers will be pleased with yields on their farms, above-trend yields across the nation have resulted in additional pressures on grain commodity prices. Given the tough budget conditions producers faced going into 2016 (expected economic losses were widespread), even lower commodity prices headed into 2017 will likely weigh on producer optimism.

Understanding the economic challenges producers face and the confidence they have in the agricultural economy plays a huge role in the ways suppliers interact with farmer clients and the way they bring value to those clients.

Enter: The Purdue/CME Group Ag Economy Barometer.

The Ag Economy Barometer

Earlier this year, Purdue University and the CME Group partnered to launch the Ag Economy Barometer, which is derived from a monthly survey of 400 agricultural producers from across the country and provides a regular measure of overall producer sentiment.

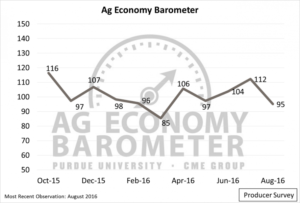

Producer sentiment has been measured and tracked since October 2015 and is shown in Figure 1. A couple key observations are noteworthy. First, producer sentiment trended lower throughout most of winter 2015 and early spring 2016. Second, commodity prices helped rally producer sentiment during the summer months, especially as producers thought about the next few years in agriculture.

Most recently, however, low commodity prices have pulled producer sentiment lower. In August, the barometer fell sharply from 112 to 95—the second-lowest reading in 11 months. This set a tone much different, and must less optimistic, than what was observed a year before.

Figure 1. Purdue University/CME Group Ag Economy Barometer, October 2015-August 2016.

Farm economy drivers

In addition to measuring broad sentiment, the Ag Economy Barometer also asks producers about key farm economy drivers. These additional questions help explain changes in producer sentiment and expectations.

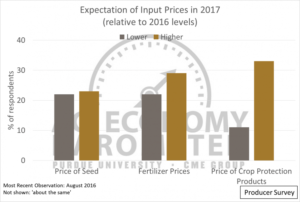

In August, producers were asked about their expectations of key input prices in 2017. Specifically, respondents were asked if they expected seed, fertilizer, and crop protection prices to be higher, lower, or about the same in 2017, relative to 2016. As shown in Figure 2, more respondents expected higher prices for all three inputs, than lower prices. This was especially true for crop protection products.

Figure 2. Producer Expectations of Input Prices, 2017 relative to 2016. August 2016.

Looking ahead

The next several months will be important to understanding the key issues and topics that will be on producers’ minds as planning for 2017 gets underway. As expected, the crop budget situation will be an important factor.

Furthermore, producer expectations for farmland values, commodity prices and general agricultural trends will be important to consider.

National Conference

The 2016 National Conference for Food and Agribusiness will include sessions that offer an in-depth look at producer expectations and discussions about industry drivers.

All of the conference sessions at the conference are geared toward helping food and agricultural businesses better navigate the current marketplace and agricultural climate. The conference runs November 16-17 in Indianapolis. Learn more at http://agribusiness.purdue.edu/program/national-conference-for-food-and-agribusiness/-2016.

About the author

David Widmar is a research associate in the Center for Commercial Agriculture specializing in agricultural trends and producer decision making. He leads the research activities for the Purdue/CME Group Ag Economy Barometer.

: