Managing risk and uncertainty (book review)

Book

Book

Courtney, Hugh. (2001). 20/20 Foresight: Crafting Strategy in an Uncertain World. Harvard Business School Press.

Reviewer

Dr. Michael Boehlje, Professor Emeritus, Department of Agricultural Economics

Book Review: 20/20 Foresight: Crafting Strategy in an Uncertain World

The food and agribusiness industries are permeated by risk and uncertainty—operating risk, such as variability in prices, productivity and cost; and strategic uncertainty, such as changes in competitor behavior or government policy and regulation.

Capturing the potential or opportunities from strategic uncertainty and simultaneously mitigating the exposures is not easily accomplished. To succeed in an unpredictable future, managers must develop practical strategies based on multiple choices that respond to the requirements of different possible futures rather than on a single strategic commitment.

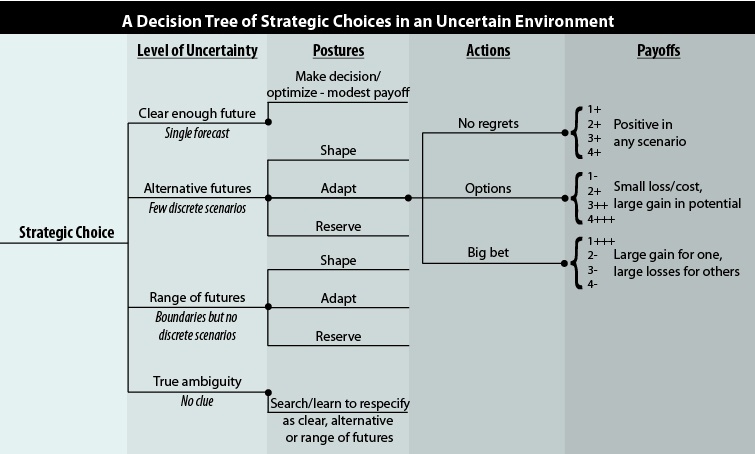

Hugh Courtney, in his book 20/20 Foresight: Crafting Strategy in an Uncertain World, provides a useful conceptual framework for making these complex decisions. Figure 1 recasts Courtney’s mental model in the analytical framework of a decision tree that can be linked to a payoff matrix.

Courtney suggests that developing strategy in an uncertain environment is a two-stage process: first, choosing a strategic posture which defines the intent of strategy; and, second, selecting a portfolio of actions that are the specific moves or activities that can be used to implement the strategy. The strategic postures are contingent upon the level of uncertainty ranging from: 1) a clear, certain future, 2) alternative well delineated futures or scenarios, 3) a range of futures but not scenarios, to 4) true ambiguity. Three strategic postures are identified: 1) shaping the future where the decision-maker attempts to drive the industry toward a new structure of their own design, 2) adapting to the future where one takes the current and future structure of the industry as given and reacts to the opportunities that structure offers, and 3) a wait-and-see approach where one reserves the right to play by making incremental resource commitments to enhance one’s ability to be a successful market participant in the future. These different strategic postures are illustrated in the decision tree of Figure 1.

Figure 1. A Decision Tree of Strategic Choices in an Uncertain Environment. (Adapted from Courtney 2001 and Boehlje 2011.)

If an adapt or shape strategic posture has been selected, three different types of actions or moves can be made to implement the strategy:

- No regrets moves that are expected to pay off no matter what future comes to pass.

- An option which is designed to secure high payoffs in the best-case scenarios while minimizing losses in worst-case scenarios.

- A big bet which involves large commitments of resources that will either pay off big or lose big.

If the reserve strategic posture is adopted, only an option action may be chosen.

An application illustrates the usefulness of this decision framework. A retail agricultural chemical supplier was assessing whether to introduce precision farming and variable-rate application services to its customers. The level of uncertainty of the effectiveness for the customer of variable rate technology was characterized as one of alternative futures with three scenarios:

- It is not cost-effective in general.

- It is cost-effective for most customers.

- It is cost-effective only for those customers who have highly variable soils.

Strategic postures and actions were identified as:

- Shape the market by being a market leader, with the action being a big bet start-up of a new division to provide the full spectrum of precision farming services.

- Adapt to the future with an options action of investing in personnel and equipment for soil testing and yield mapping that could be used to support an expanded precision farming program, including variable rate application, or could be used to improve the quality of recommendations, service and application with standard equipment.

- Reserve the right to play by developing a joint venture with an out-of-market partner who operates in an area with highly variable soils with an option to buy (or sell) the business depending on developing market conditions.

Framed as these strategic choices, the company altered its initial choice from being a market leader providing the full spectrum of services to a joint venture with an out-of-market partner.

Courtney’s book provides valuable insight into how to make decisions in these more uncertain times. His analytical framework helps one respond to Nicolas Taleb’s (of The Black Swan fame) mantra: You can’t predict the future, but you can position for the challenges and opportunities.

RELATED POSTS:

A great moment for value-based sales in agribusiness

Value-based sales can empower companies to craft compelling value propositions, understand the customer’s business model and effectively communicate to stakeholders.

How can big data empower the development of new products?

Data is one of the most powerful resources for a company. It enables accurate decision-making and minimizes risk, ensuring greater revenue and sustainable growth.

Unlocking Growth: Exploring innovation dynamics in the agrifood sector

The future for the agrifood sector appears promising, driven by technological advances, strategic M&A activity and a growing commitment to innovation.