Reviewer

Reviewer

Xavier Miranda, Graduate Research Assistant and Dr. Brady Brewer, Assistant Professor

Article

Cultural impact on mobile banking use – A multi-method approach by Winnie Picoto & Inês Pinto

Journal

Journal of Business Research, January 2021, Vol 124, Pages 620-628

Summary

Technological advances are being made in many areas such as big data, biotechnology, robotics and machine learning, just to name a few. These technological improvements have trickled down into everyday life in the forms of widely available internet connection and cell service. Any piece of information can be accessed by a few clicks of a mouse or a few swipes on a phone. Mobile banking is no exception, and it has the potential to become a standard business practice. Mobile banking still lags behind other forms of technology in terms of adoption as some people still prefer to use other means such at Automated Teller Machines (ATM) or drive through banking. However, the rate in which people are adopting mobile banking is increasing rapidly.

Banks have invested in digital platforms such as mobile banking in efforts to provide clients with more flexible options to conduct business. Despite the wide availability of mobile banking apps, this is one of the least adopted styles of self-banking features. This technology shows great promise; however, it currently lags behind the usage of ATMs and e-banking. This paper aims to explain the relationship between the availability and intention of use of mobile banking at its actual usage.

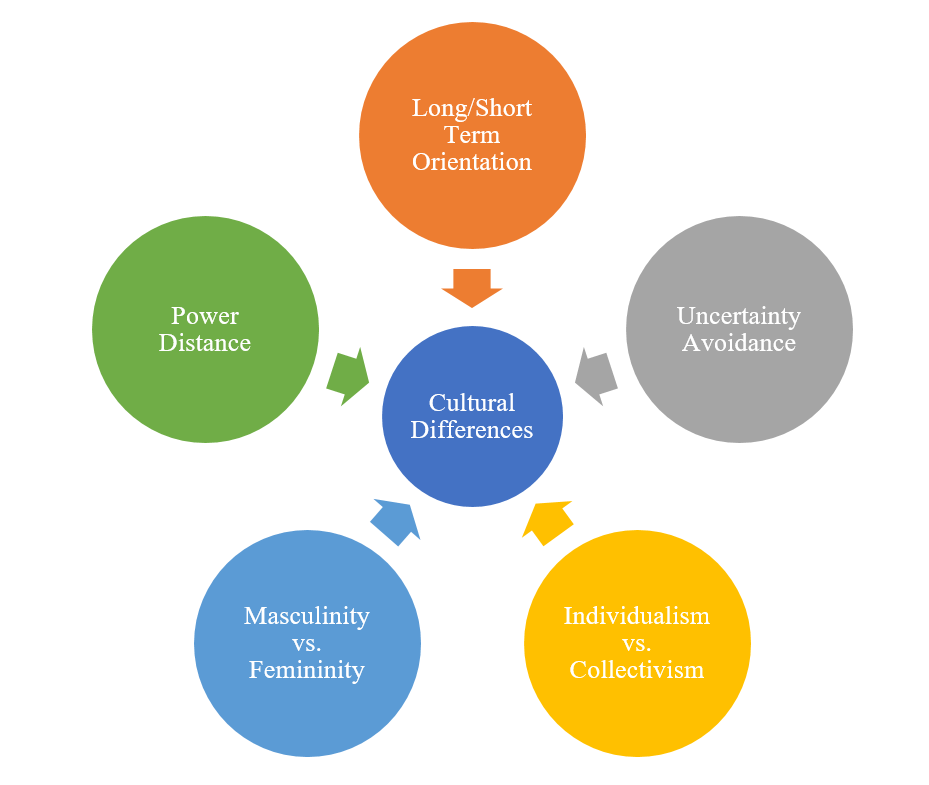

This study elaborates on the relationship of factors such as bank reputation, structural assurance, performance expectancy, facilitating conditions, credibility, perceived usefulness and risk of mobile banking use. While these factors are all important from a decision maker’s perspective, the factors found to be the most significant were bank reputation, credibility and risk perception. This paper applies Geert Hofstede’s five cultural dimensions on data from four countries to explore the relationship between the intended usage of mobile banking and its actual usage. Hofstede’s cultural dimensions are power distance, individualism vs. collectivism, long term orientation, uncertainty avoidance and masculinity vs. femininity. The cultural dimensions were developed to help explain differences in culture. In this case, the study concluded that power distance, uncertainty avoidance and long-term orientation are cultural moderators on the usage of mobile banking.

Geert Hofstede’s Five Cultural Dimensions

What this means for Food and Agricultural Business

Agricultural banking has historically been a relationship-driven industry. Farmers tend to use local lenders and develop a personal relationship with their loan officer at the lending institution they use. Mobile banking would undoubtedly decrease the relationships between lenders and farmer customers. However, this is not necessarily a bad thing, but it would necessitate change with how the lending institution reaches its farmer customers.

As mentioned in the research article, mobile banking has actually lagged behind other forms of technology adoption for a variety of reasons. This is especially true in the agricultural sector due to a couple of reasons. First, agricultural lending institutions have tended to be smaller in size as the larger lending institutions do not hold a large portfolio of agricultural loans. These smaller lending institutions have been slower to invest in mobile banking applications that their farmer customers may use; however, this is changing rapidly. Secondly, agricultural lending is highly specialized and requires a fair amount of oversight relative to other types of lending. So while large mortgage provides can provide a customer with a loan approval for a house mortgage, it is much harder to do an automated loan product for an agricultural loan. Underwriting is much more specialized, and lending institutions typically need more information on the farm business than what is required for a typical home mortgage. This is a significant barrier to mobile banking in agriculture. There are lending institutions that have developed some form of autonomous loan approval, but for smaller segments of agricultural lending such as tractors or other equipment that can be underwritten fairly universally.

The study found that bank reputation and credibility are positively related with mobile banking use, and the potential for user risk negatively influences mobile banking use. What is surprising here is that perceived usefulness is not one of the significant factors leading to adoption of mobile banking platforms. It would be expected that if a farmer customer is going to adopt the mobile banking platform, they would want to be able do most of their banking online. This shows that the customer knows that mobile banking applications are limited in use and they will still need other methods of conducting their financial business with their lending institution.

With the increasing trends of paperless and other digital business practices, banks should make every effort to stand out to potential customers. Banks should also continue to provide quality services and financial products that continue to grow and develop relationships with customers. Agricultural banking is no exception, and decision makers should stay on top of this developing trend. Banks that develop mobile banking infrastructure that consumers have faith in can increase the usage of their mobile banking platforms.