by David Widmar and Brent Gloy

by David Widmar and Brent Gloy

Do producers who expect their operations to grow treat their businesses differently than other producers do? We looked into this segment of farmers in a recent survey and found surprising results that agribusinesses might find useful in forecasting future business transactions.

Background

The Center for Food and Agricultural Business at Purdue University recently conducted its Large Commercial Producer Survey in order to capture the buying habits of large growers. By asking producers about their current acreage and future acreage plans, researchers were able to evaluate growth plans. By digging just below the surface, we uncovered a wealth of insights.

This work placed crop producers into four groups: negative-growth, no-growth, slow-growth and high-growth. Producers categorized as slow-growth reported annualized growth rates of 5.4 percent or less. High-growth producers were those with growth rates greater than 5.4 percent. Slow- and high-growth producers accounted for 22.4 percent and 25.0 percent of crop producers, respectively.

Demographics

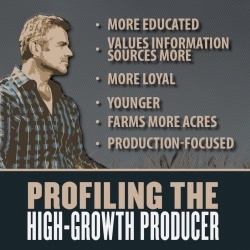

The first challenge we tackled was to determining what these high-growth producers looked like from a demographic standpoint.

More Educated

The largest group of both slow- and high-growth producers reported having completed a four-year education. This is compared to the largest group of negative- and no-growth farmers, who reported a high-school degree.

Younger

The largest group of high-growth producers was 40-54 years of age. This is compared to the largest group of the other producer groups (negative-, no-growth, and slow-growth producers), which was 55-69 years of age.

Larger Operators

Large operators reported growth expectation in acres more than twice as high as other producers. This doesn’t come as a significant surprise, as, even with modest annualized growth, large-acre expansion is often more obtainable.

Sources of Information

In the survey, respondents reported the value they found in 14 various media sources ranging from social media (one of the lowest-rated overall) to farm publications (the highest-rated overall). What stood out most was that high-growth producers considered all media sources more important than their peers did.

High-growth producers are seekers of information, and from every source. High-growth producers really broke from the pack in the area of technology-centric sources, rating text messages, e-mail newsletters and websites as much more important than their peers did.

Loyalty

The first trend we noticed with regard to loyalty is that high-growth producers self-reported being more loyal than their peers to their seed brands and retailers. The second trend was this: when asked if they would switch seed brands or retailers for a price savings opportunity, high-growth producers were the least likely to report being willing to switch.

While loyalty can mean a lot of different things to different customers and businesses, high-growth crop producers emerged as more loyal in their seed purchases.

Producer Strategies

Finally, high-growth producers, as a group, place emphasis on different strategies for success than other groups do. The survey asked producers about five factors that contributed to their operation’s success: managing production; managing land, equipment and facilities; controlling costs; managing people; and managing output prices. All producer groups placed similar emphasis on three of the factors. But for managing production and output prices, a difference emerged.

Producers with high-growth expectations placed more emphasis on managing production and less emphasis on managing output prices.

While each specific operation has its own secret sauce formula for success and each producer should be approached with his or her specific needs in mind, it’s helpful to keep in mind that, as a group, producers with expectation to grow, especially high-growth rate plans, will be thinking about managing their production — especially yield — more than their peers will.

Segmentation of customers can be a helpful tool in meeting the needs of differing customers. It’s important to think about customer segmentation in a meaningful way for each organization and each product or service. There are numerous ways that you can segment your customers. Think about how you can dig deeper than casual observation to glean potentially valuable insights.

Results from the Large Commercial Producer Survey were presented at the 2013 National Conference for Agribusiness.

This article originally appeared in Agri Marketing and is reposted here with permission.

: