Reviewers

Dr. Jeffrey Hadachek, Assistant Professor, University of Wisconsin-Madison; Dr. Meilin Ma, Assistant Professor, Purdue University

Article

Market structure and resilience of food supply chains under extreme events by Jeffrey Hadachek, Meilin Ma and Richard J. Sexton

Source

Hadachek, J., Ma, M., & Sexton, R. J. (2023). Market structure and resilience of food supply chains under extreme events. American Journal of Agricultural Economics, 106(1), 21–44. https://doi.org/10.1111/ajae.12393

Summary

Agricultural and food markets in the U.S. have been tested in recent years by the COVID-19 pandemic, geopolitical conflict, extreme weather and drought. These events have led to elevated prices and, in some cases, stockouts of key food staples for Americans. Subsequently, businesses and policymakers have debated potential weaknesses along supply chains and ways to make them more robust to similar events in the future. This article examines four system-wide approaches to resilient supply chains and their cost-effective implementation under alternative scenarios.

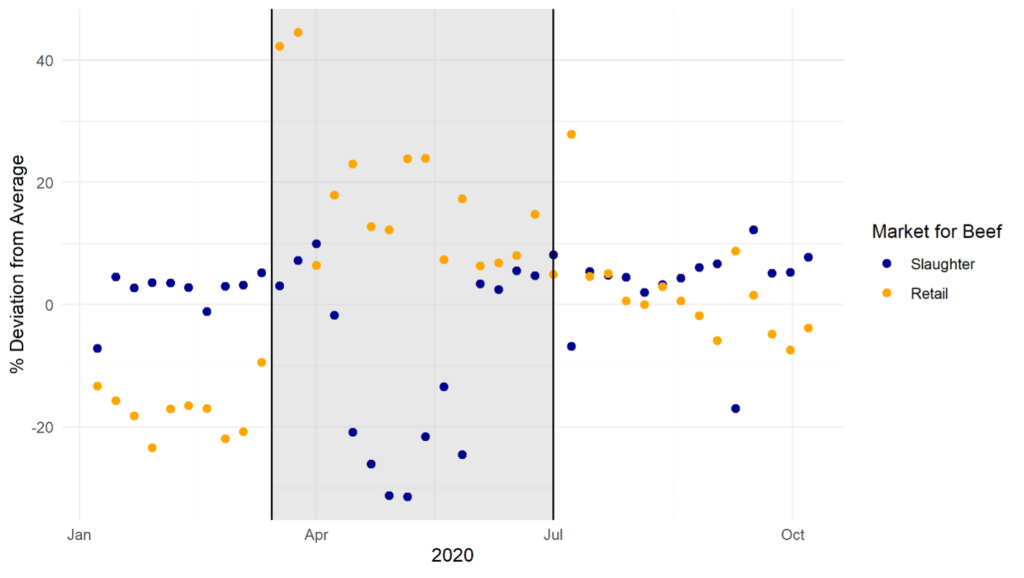

The interconnected disruptions across supply chain stages, exemplified by the COVID-19 pandemic, made them particularly difficult to navigate and predict. Not only did the COVID-19 pandemic create bottlenecks in food processing but also changed consumption patterns, where demand for food-at-home increased sharply. Take the market for beef represented in Figure 1 as an example. Demand for beef at retail increased by as much as 42% in mid-March 2020, as quarantine measures and social distancing prompted a shift from food-away-from-home to food-at-home. However, during this period, slaughter capacity decreased by over 25% at the same time.

The simultaneous impact of extreme events across multiple aspects of the supply chain adds additional uncertainty to market outcomes and complexity in managing such events. Key to this question is the tradeoff between resilience and efficiency in supply chain risk management strategies, whether implemented by individual businesses or by policymakers. For example, a highly diversified supply chain may limit risk exposure when unpredictable events happen, but maintaining diversity during normal periods comes at the cost of specialization (or economies of scale) and may raise downstream food prices. Hadachek et al. (2024) address this tradeoff in their economic model, comparing outcomes for farmers, supply chain intermediaries (e.g., processors, distributors, and grocers), and food consumers when simultaneous shocks impact each stage.

In practice, several key policies have been proposed to alter supply chains and market structure from the status quo: i) Increased antitrust enforcement and encouraging competition, ii) supporting the entry of small to medium-sized food processors, iii) anti-price gouging laws to limit rapid food inflation and iv) localizing food systems. Their model demonstrates how each of these strategies, in isolation, impacts the volatility of outcomes and measures the costs to efficiency.

The findings show that there is no “one-size-fits-all” approach to creating more resilient supply chains in the presence of catastrophic shocks, and no “win-win” solution exists. For example, adding more processing capacity lowers the volatility of consumer welfare and farmer profits by about 25%, but reduces the revenue earned by agribusinesses in the middle of the supply chain. In another case, localizing agricultural production and creating more geographically dispersed markets can reduce volatility by up to 10%, but the inefficiencies from doing so may increase downstream food prices and hurt consumers on average by up to 15%.

In summary, prescribing supply chain resilience policies without broader unintended consequences in the market is challenging. Caution must be exercised when introducing drastic changes to the structure of supply chains, and decision-makers must balance the costs of risk management during normal times versus the potential benefits when low-probability, but extreme events occur.

What does this mean for food and agribusiness?

Risk management is a core issue for agribusiness, especially given increasing disruptions across various parts of the food supply chain. As mentioned, a set of policies have been imposed on the U.S. food supply chains in response to COVID-19. Interactions between policies and firm responses have key impacts on supply-chain resilience. On one hand, policy interventions add complexity to the selection of resilience strategies for agribusiness firms. When the policy supports the entry of small and medium meatpackers, for instance, incumbent meatpackers likely see decreased profits. Consequently, they may reduce the investment in resilience due to lower returns on stabilizing outputs. On the other hand, firm responses to disruptions, like vertical coordination and mergers, may change the competition landscape, thereby influencing the effectiveness of resilience policies.

A key factor that Hadachek et al. (2024) do not discuss is the interdependence among resilience investments made by firms. This interdependence among risk management strategies can be strong due to the nature of disruptions in the food supply chain (e.g., infectious animal diseases) and complicated because of the extensive network of suppliers spanning from upstream to downstream.

For example, when a livestock operation decides how much to invest in biosecurity measures (e.g., monitor for animal epidemics), it recognizes that the return on its investment, namely, reducing the probability of disease among its herd, also depends on the investments of neighboring operations. In such cases, risk management investments complement each other. In other scenarios, agribusiness risk management may create a free-rider problem, where one firm receives benefits from the investments of others, implying substitution of investments. Of course, in some instances, firm choices are independent of one another (e.g., renewing the fire alarm in a plant).

The optimal resilience strategy of an agribusiness depends on a set of factors – the firm’s objective, its infrastructure and capital, constraints, policies, and interdependence on other players in the supply chain. It is a complex choice and varies as the factors evolve. Whether or not food supply chains undergo significant changes, recent challenges are a reminder of unpredictability at every stage of our food system. Managers would benefit from carefully considering the costs and benefits of enhancing preparedness and flexibility for the future.