Book

The Digital Transformation Playbook: Rethink Your Business for the Digital Age by David Rogers

Reviewer

Dr. Allan W. Gray, Executive Director and Professor

Summary

In The Digital Transformation Playbook: Rethink Your Business for the Digital Age, David Rogers identifies five domains of digital transformation for an existing company. The figure below identifies those five domains as customers, competition, data, innovation and value.

Figure 1. The Five Domains of Digital Transformation identified by David Rogers.

In his book, Rogers includes key changes for each of the five domains that should be considered in the digital age. The book also features a survey that asks respondents to examine their company’s current adaption to the key strategic concepts associated with the five domains. Additionally, it asks respondents to examine their organization’s ability to put these concepts into practice within their company.

What this means for Food and Agricultural Business

As we consider disruption and innovation in the food and agribusiness industries, I think the concept of these domains provides useful insights. Of course, not all disruption in food and agribusiness is digital in nature, but much of it is. And I believe that many of these concepts can be generalized to other forms of industry disruption that challenge incumbent firms to consider transformation in their businesses.

To examine the five domains in the context of the food and agribusiness industries, I asked participants of the 2019 Purdue Food and Agribusiness Executive Summit to complete Rogers’ survey. I then analyzed the results of their responses and compiled my findings and observations below.

Customers

In the survey, respondents were asked if their firms used marketing to target, reach and persuade customers, or if they use marketing to attract, engage, inspire and collaborate with customers. Sixty percent of respondents indicated that their firms use marketing as more of a means to target, reach and persuade customers rather than to attract, engage, inspire and collaborate with them. Additionally, 63% of respondents said that their firms are more focused on selling to and interacting with customers through traditional channels rather than being focused on customers’ changing digital habits and path to purchase.

These results indicate that many of us are still concentrating our sales and marketing efforts on pre-digital strategies and trying to discover more effective ways of engaging with customers through digital platforms. However, another question in the survey asked respondents if their brand and reputation are communicated to customers, or if their customers’ advocacy was the biggest influence on their brand and reputation. Half of respondents recognized the importance of customer advocacy in influencing brand reputation.

Competition

Survey results centered around competition questions provided some interesting takeaways. When asked if their firm’s sole competitive focus is on beating out its rivals or if their firm is open to cooperating with its rivals and competing with its partners, 63% of respondents believed they are open to working with rivals. In addition, 59% said that they seek to compete on platforms and external networks rather than just competing on products. This is particularly surprising as I view this industry as traditionally very focused on product competition. Perhaps we are seeing a shift in focus?

As we prepare for the new digital age, 56% of respondents indicated that they focus on direct competitors rather than a broader range of competition outside of our traditional industries. This strategy may potentially be leaving food and agribusinesses vulnerable to disruption from outside of the normal competition sphere.

Data

Survey results centered around data strategy questions suggested that many respondents’ firms have moved beyond the stage of discovering how to best collect and store data. When asked if their organization was more focused on creating, storing and managing data or more focused on turning data into new value, a majority (67%) of respondents indicated that their firms are more heavily focused on how to create value from the data they collect. However, when asked if data stays in the business unit where it is generated or if data is instead organized to be accessible by all division of the company, 67% of respondents indicated that their company struggles with the issue of siloed data. A majority of respondents feel that it is difficult to give everyone within the company access to the data.

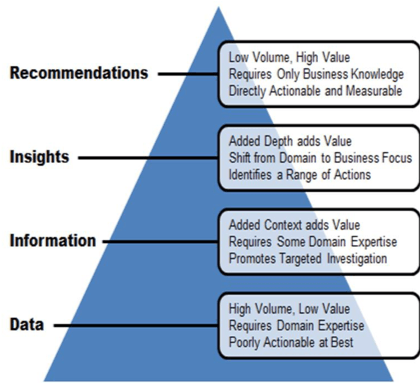

I wish Rogers had titled his chapter over data strategy to be “Data to Implications” rather than just “Data”. Data by itself is not very useful, and I think we have seen this play out in our industry. For example, in precision farming, we have been accused of mostly “creating pretty maps” in the past. We have made great strides in the last several years to move past this low–value data exercise, and the key is to continue moving from just data to more insightful recommendations drawn from the data. In other words, the Insights Pyramid, shown in Figure 2.

Figure 2. Insights Pyramid

Innovation

When asked if innovation projects usually go over time and budget or if innovation occurs in rapid cycles using prototypes to learn quickly, survey responses fell exactly even between the two. Half of respondents believe their firms’ projects exceed time and budget, while the other half feel their firms are quick to innovate and learn. Additionally, when asked if firms try to avoid failures in new ventures at all costs or if firms accept failures but look to reduce cost and increase learning, it was surprising to me that over half of respondents (57%) indicated that their firms are accepting of failure in innovation projects while reducing costs and increasing learning. Although, a fair amount still believed their firms struggle with accepting the concept of failure in innovation.

Some respondents indicated that their firms’ innovation projects are slow and overbudget, yet they also indicated that their firms see low-cost failure and increased learning as a part of their culture. This seems contradictory to me, and I am curious how this came to be.

Value

When thinking about value, most respondents believe their firms’ value proposition is defined by customer needs rather than its products and the industry. Most of them also felt that new technology departments are focused on customers and their changing needs rather than how new technologies will impact their current business.

However, when asked if respondents’ firms are more focused on executing and optimizing their current business, or if their firms aim to adapt early to stay ahead of change, 57% said their company is more focused on current business. While this seems a bit inconsistent to me, perhaps our customers’ needs are not changing very rapidly and, therefore, we do not need to worry about “staying ahead of the curve.” Alternatively, it may be that we want to be customer–centered in our value propositions but our companies are naturally more conservative, or we lack the skills to understand how our customers’ needs are changing. So, despite wanting to be customer–centric, we end up being focused on improving internal operations rather than diligently seeking new value propositions because it is more comfortable and has historically been successful.