Large Commercial Producer trend analysis for seed and animal feed and nutrition

Over the past decade, large commercial producers have steadily shifted their decision-making criteria when purchasing key farm inputs like seed and animal feed. While price and relationships once held significant sway, the latest data trends from Purdue’s Large Commercial Producer (LCP) survey point to a market that is laser-focused on performance and outcomes.

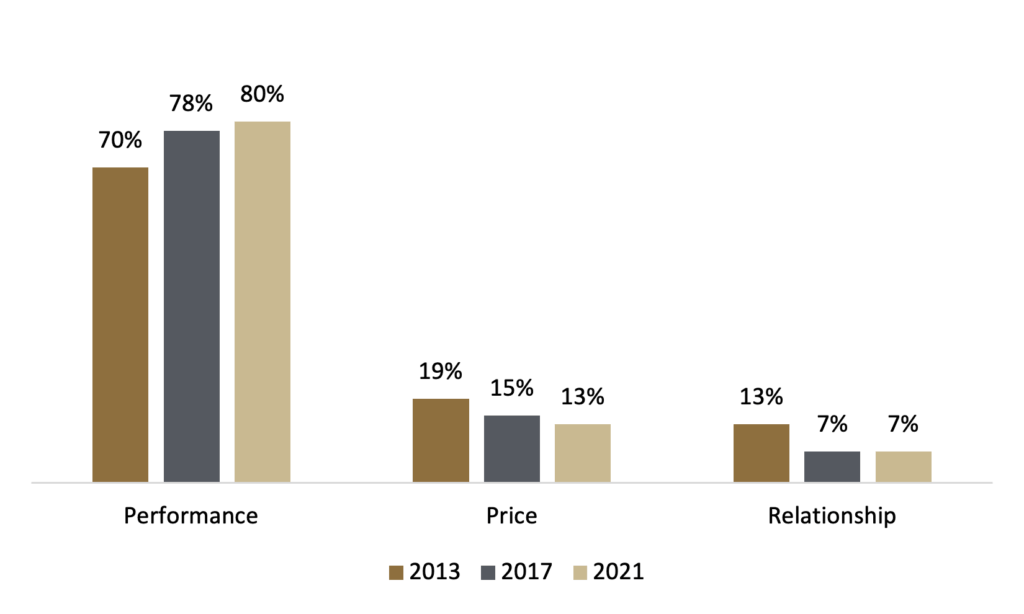

A decade of seed purchasing trends

When it comes to seed, performance is increasingly dominant. In 2013, 70% of farmers ranked product performance as the most important attribute in their purchasing decisions. That number climbed to 78% in 2017 and reached 80% in 2021, showing a clear and steady trajectory. Today’s producers are prioritizing ROI and yield potential over time and over everything else.

Price remains a factor but has declined in importance, dropping from 19% in 2013 to 13% in 2021. Relationships have followed a similar path, falling from 13% to 7% over the same period. Together, these shifts point to a market increasingly driven by outcomes and ROI rather than the personal relationships that once played a more central role.

While product performance is leading the conversation, relationships still matter. In today’s environment, relationships are most valuable when they help communicate performance, support decision-making and deliver real value. With large producers favoring quantifiable results over loyalty or cost alone, seed suppliers will need to demonstrate performance gains clearly and consistently.

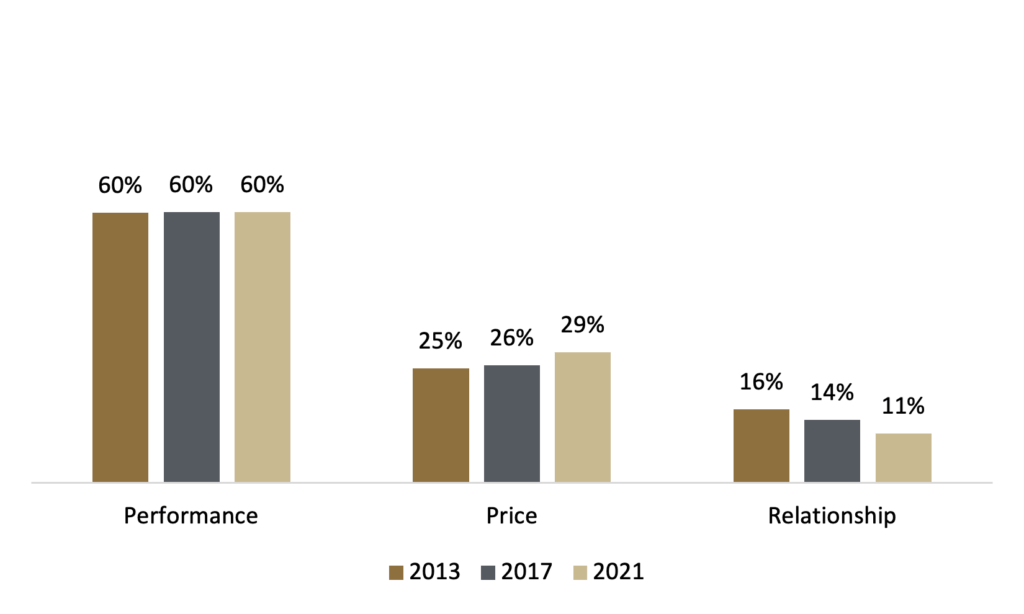

What about animal feed and nutrition?

While seed purchasing has become more singularly focused on performance, animal feed and nutrition tells a slightly different story.

Product performance is still king with 60% of producers identifying it as the top priority across all three survey years (2013, 2017 and 2021). But unlike seed, price sensitivity is increasing here. The importance of price rose from 25% in 2013 to 29% in 2021, which suggests producers may be feeling more margin pressure in their feed decisions.

Just like in seed, relationship-based purchasing of animal feed and nutrition is on a gradual decline, moving from 16% in 2013 to 11% in 2021. The common theme? A growing emphasis on value and measurable results.

What will 2025 reveal?

These shifting preferences are important indicators of how large commercial producers think and act when making high-stakes decisions. But the story doesn’t end here.

We’re currently in the process of collecting responses for the 2025 LCP survey. While we can’t say yet what new insights will emerge, this new data will continue to help us understand how producers’ priorities evolve.

Have these trends continued, or are we beginning to see a new shift in producer priorities?

Will performance still dominate, or will emerging technologies, supply chain pressures or sustainability demands shake up the status quo?

Follow us for updates and insights as we roll out the next wave of findings.

If you’d like to be among the first to see the 2025 results, reach out to Aissa Good at aissa@purdue.edu. Or, if you’d like to send the survey to your farmer customers, contact Masie Keshavarz mkeshava@purdue.edu for a direct link.