Understanding how farmers view their input dealers and retailers offers valuable perspective for agribusiness leaders working to improve service quality, strengthen relationships and build long-term loyalty. Drawing on findings from Purdue’s Large Commercial Producer (LCP) surveys conducted in 2017, 2021 and 2025, this post offers a sneak peek at a few emerging insights from the newest survey and a look back at how farmer perceptions have evolved over time.

Relationships still matter most

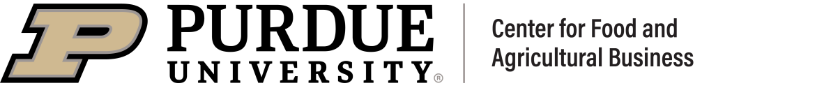

Across nearly a decade of survey data, one finding has remained consistent: relationships drive loyalty. Farmers continue to agree most strongly with “relationship with salespeople is more important than their relationship with the company those individuals represent.” Average ratings have consistently hovered around 6.8 to 7.0 on a 9-point scale, underscoring a familiar truth in agricultural sales: trust is personal, not institutional.

Despite market consolidation and the rise of digital tools, the farmer-salesperson connection remains a strong anchor in purchase decisions and brand loyalty.

Growing recognition of service and information quality

Farmers are also increasingly aware of differences in the quality of service and technical information provided by dealers and retailers.

- Service quality differences rose from 6.4 in 2017 to 7.0 in 2021, holding relatively high in 2025.

- Differences in quality of technical information and advice similarly climbed from 6.0 in 2017 to 6.4 in 2021 and remained steady in 2025.

Over time, producers have become more discerning, evaluating not just products and price, but the overall value experience – from quality of advice to follow-through on service commitments. This trend suggests that farmers are sharpening their expectations and comparing dealers based on credibility and differentiated expertise.

Farmers' confidence in product knowledge is rising

Another notable shift over time is farmers’ growing confidence in their own product knowledge. Although the statement “I know more about my expendable products than my dealer or retailer” still receives the lowest average rating among all perceptions, scores have a steady upward trend.

The average score increased from 4.4 in 2017 to 5.0 in 2025, indicating a more self-reliant, technically sophisticated producer.

Figure 1. Farmer perceptions of agricultural input dealers and retailers

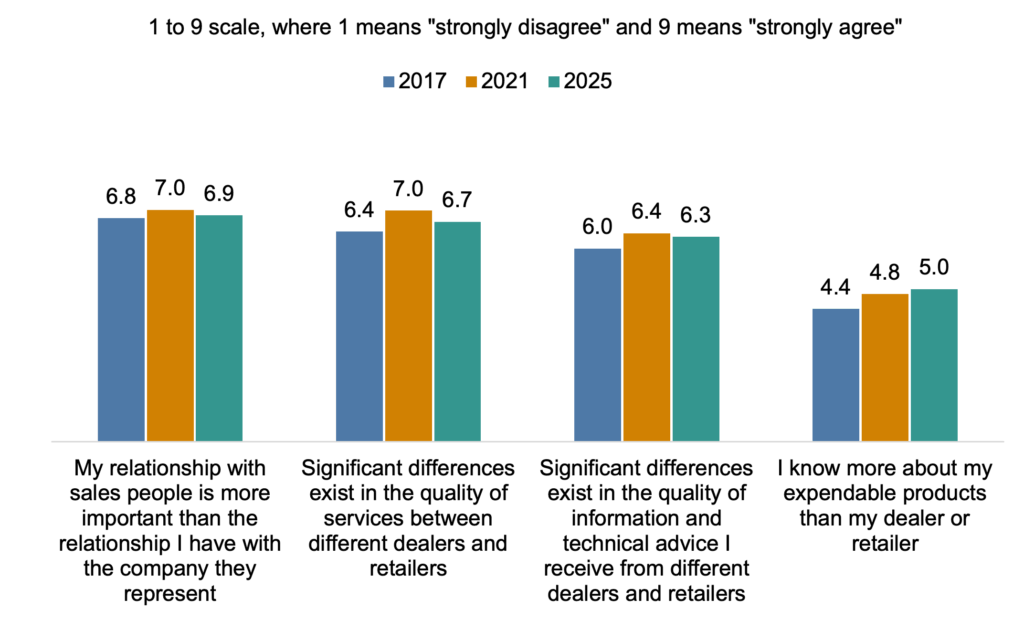

The belief that farmers “know more than their dealer or retailer” has increased across most primary operations, including both crop and livestock farms. While crop producers generally report slightly higher confidence, the upward trend is consistent across sectors. These results highlight a broad-based pattern of growing knowledge empowerment among producers.

Figure 2. Farmers’ confidence in knowing more than their dealer or retailer by primary operation

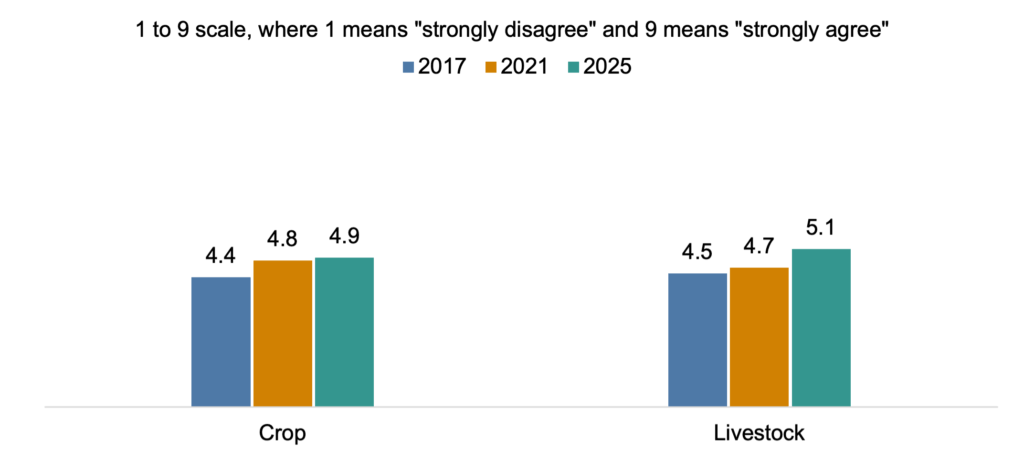

To explore whether farm scale influences this perception, operations were categorized using the USDA Census of Agriculture’s Farm Typology in the table below.

Farm Size | Gross Cash Farm Income GCFI |

Mid-size | $500,000 – $999,999 |

Commercial | $1,000,000 – $4,999,999 |

Large | > $5,000,000 |

As shown in Figure 3, confidence in product knowledge rises with farm size. Larger farms, which typically have more professional management structures and dedicated procurement staff, report stronger agreement with this statement. These results suggest that experience, operational scale and access to data-driven decision tools contribute to producers’ growing expertise.

Figure 3. Farmers’ confidence in knowing more than their dealer or retailer by farm size

Key takeaways for agribusinesses

- Relationships remain the foundation of loyalty. Even as digital engagement grows, personal trust continues to drive buying behavior.

- Farmers increasingly discerning customers. Perceived differences in service and advisory quality highlight opportunities for dealers to provide value beyond price.

- Knowledge gaps are narrowing. As farmers gain technical confidence, dealers must elevate their consultative and data-driven capabilities to remain relevant.

- Segmentation matters. Engagement strategies should reflect differences in operation type and scale. What resonates with a large commercial crop producer may not connect with a mid-sized livestock operation.

The evolving farmer-dealer relationship is more informed, more analytical, yet still deeply relationship-driven.

This blog represents just a small preview of the 2025 Large Commercial Producer Survey results. Director Scott Downey will present a high-level overview of the results during our upcoming winter “road show,” with sessions at several upcoming industry conferences:

- 2025 ARA Conference & Expo

The Grand American, Salt Lake City, UT | Dec. 3, 2025 | 1:30-2:45 p.m. - ASTA Field Crop Seed Convention

Hyatt Regency Orlando, Orlando, FL | Dec. 12, 2025 | 8:30-10:00 a.m. - 37th IPSA Annual Conference

JW Marriott, Indianapolis, IN | Jan. 14, 2026 | Learning Session 2, 10:00-11:00 a.m.

More detailed insights will be shared publicly by late January 2026.

Until then, we invite you to join us at one of these sessions or reach out directly to Aissa Good at aissa@purdue.edu to request an early release of the findings.