Author: Dr. Nathan DeLay, Assistant Professor

Author: Dr. Nathan DeLay, Assistant Professor

There is a lot of talk about “big data” in agriculture these days. The farm of the future is said to use multispectral imagery, soil and micro-climate sensors, equipment telematics data, and GPS to drive yield enhancing decisions. The growth of ag-tech startups suggests investors are optimistic about this future. Investment in the ag-tech sector grew 43% in 2018 to nearly $17 billion according to AgFunder News.[1] Though the amount of data being collected from farms is growing rapidly, little is known about how farmers leverage this data to make decisions. According the USDA’s Agricultural Resource Management Survey (ARMS), 61% of corn growers used a yield monitor in 2010 but only 34% used the data to generate a yield map, indicating a disconnect between data collection and data action. The nearly $1 billion sale of Climate Corp to Monsanto (now Bayer) highlighted the value of aggregating farm data with software platforms, but questions regarding farmers’ use of data services persist. What types of farm data software do farmers subscribe to, and to what extent does this software influence seed, nutrient and chemical decisions? To begin to answer these questions, researchers from Purdue University’s Center for Commercial Agriculture surveyed 800 corn and soybean producers about their collection, management and usage of farm data. Farms with 1,000 acres or more were targeted to produce a sample of farms most likely to have active data strategies.

Participants were asked if they collect yield monitor data, soil sample data or imagery data from a drone or satellite. Results suggest that for large operations, data collection is a routine part of their business. Eighty-two percent report using a yield monitor, 77% perform soil testing and 47% collect drone or satellite imagery. Use of data software is also high at 44% of all respondents. Among data software users, the most popular are Climate FieldView (52% of subscribers), John Deere Operations Center (44%), Case-IH AFS Software (22%) and Trimble (21%). Large corn and soybean growers are not averse to sharing their data with service providers—74% share their data with an agronomist, input supplier, custom service provider, equipment dealer or other outside party for the purpose of generating crop management recommendations.

Ultimately, our interest is in the impact of data, once collected, on actual farm management decisions. To get at this, the survey asked participants to rate the extent to which their data informs their decisions in three areas: seeding rates, nutrient management and drainage investments. Thirty percent of those collecting data report that their data has a large influence on their seeding rate decisions. For nutrient management and drainage decisions, the proportion is 54% and 30%, respectively. Decision makers were followed up with a question about the effect of their data-driven decisions on yield outcomes. Over 70% of those using data to make decisions report a positive yield impact, indicating a high degree of satisfaction with their data strategies.

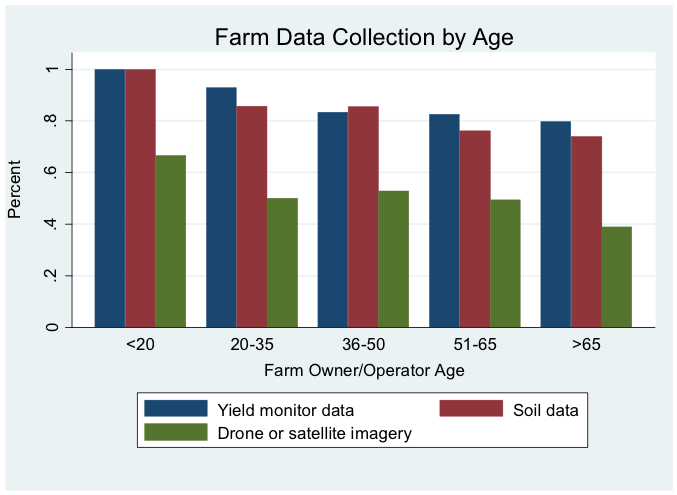

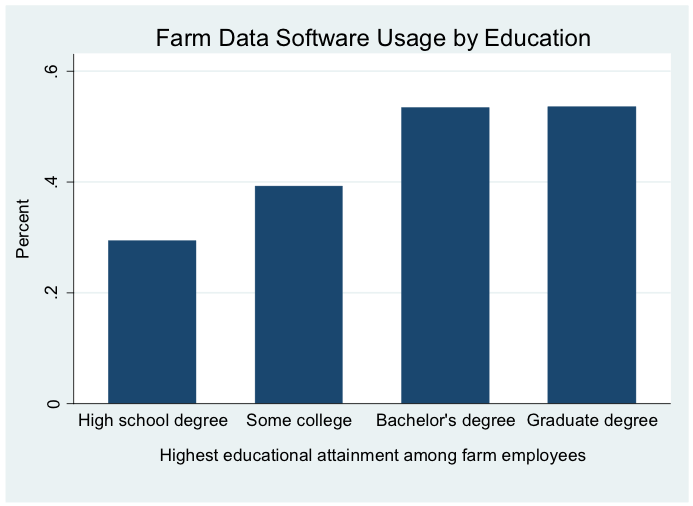

Data collection and use appears to rise with farm size—a finding consistent with existing research—but is also related to the characteristics of the farm and farm operator.[2] Farms where the principal owner/operator is young are more likely to collect data than farms run by older operators (see Figure 1). Similarly, use of data software platforms rises with education. Farms where the highest educational attainment is a graduate degree (Master’s and above) are nearly twice as likely to subscribe to a data software service than those with a high school diploma (see Figure 2).

Understanding how data management practices shape on-farm decision making is of crucial importance in bringing the farm of the future into reality. Downstream players in the agricultural value chain need to recognize the data needs of growers as data transparency and data integration demands rise.

Figure 1. Farm Data Collection by Age

Figure 2. Farm Data Software Usage by Educational Attainment

Beyond the Blog

Purdue faculty will release additional detailed results of the data research study at the National Conference for Food and Agribusiness on November 6-7, 2019 in West Lafayette, IN. Professionals from across the value chain will have the opportunity to come together to learn about insights and implications relevant to food and agricultural business, discover solutions to today’s challenges and gain knowledge on how to shape their organizations and customer interactions for optimal success. Register now!

[1] AgFunder. AgFunder AgriFood Tech Investing Report: 2018 Year in Review. (2019). Available at https://agfunder.com/research/agrifood-tech-investing-report-2018/

[2] Schimmelpfennig, D. (2016). Farm Profits and Adoption of Precision Agriculture. U.S. Department of Agriculture, Economic Research Service Report No. 217, Washington, D.C.: