Author: Dr. Brady Brewer, Assistant Professor

Author: Dr. Brady Brewer, Assistant Professor

The agricultural sector is highly competitive. At every level of the value chain, participants compete for market share, cost advantages or any other strategic advantage. With advancements in technology, customer segmentation practices and a changing consumer base, it is no surprise that many firms are turning to data analytics for some type of strategic advantage. Data give insights into both demand and supply issues, helping companies better target new customers or cutting costs of production along the way. Regardless of its use, increasing the bottom line is the end goal.

This year, the Purdue University Center for Food and Agricultural Business conducted survey research on data usage and analytics along the food and agricultural value chain from the farmer to the food retailer. We wanted to research how much data participants gathered, analyzed and shared across the value chain. What we found was extremely insightful into how different firms view their data and how it is used.

With over 1,500 responses from all levels of the value chain and all different levels of employees and roles, the sample is highly representative of the overall food sector. From salespeople to CFO’s, views of data and the strategic decisions data help to drive were analyzed. While other research has focused on one particular sector of the value chain, this research is the first comprehensive look at the entire data environment from farmer to consumer.

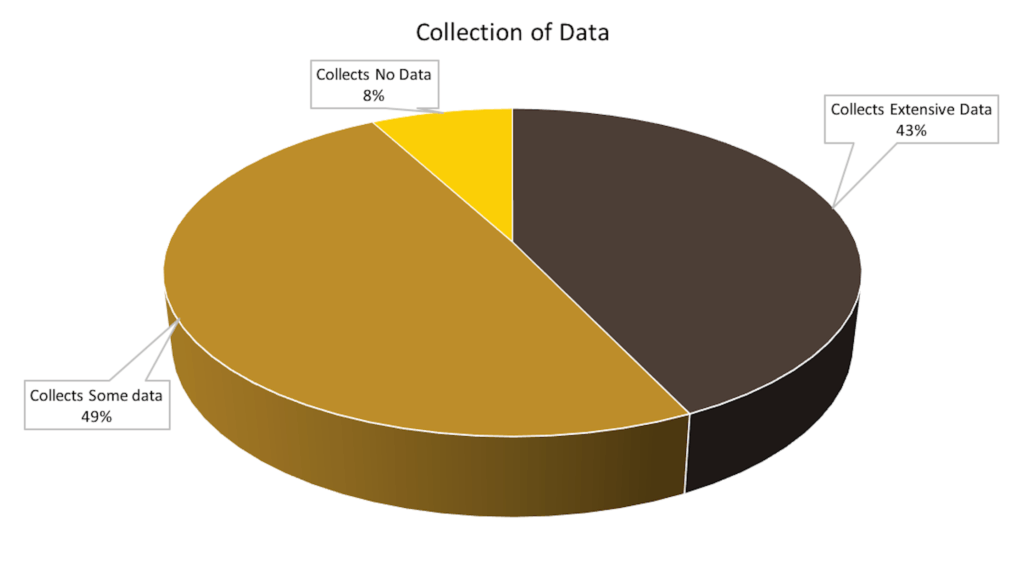

Ninety-two percent of the sample indicated that the agribusiness they work for collects data with 43 percent saying their agribusiness collects an extensive amount. This, given the above statements about firms trying to gain any strategic advantage possible, may come as no surprise.

Ninety-two percent of the sample indicated that the agribusiness they work for collects data with 43 percent saying their agribusiness collects an extensive amount. This, given the above statements about firms trying to gain any strategic advantage possible, may come as no surprise.

However, when we asked respondents to grade their company on the use of this data, only 30 percent said that their organization was using it to the full advantage. About half of respondents said their firm is at par or behind the competition. This could be because respondents indicated that collecting data in a usable form in a timely manner is the biggest challenge their company faces in order to fully utilize the data. In other words, decisions are being made faster than a company can collect and analyze their data!

How data is used in the value chain and what insights it generates is going to be of vital understanding in the future. Huge swathes of data are being generated from farmers to consumers. The agribusinesses that are able to harness the power of this data to both minimize costs and reach new customers will be successful along the way.

Beyond the Blog

Purdue faculty will release additional detailed results of the data research study at the 2019 National Conference for Food and Agribusiness on November 6-7, 2019 in West Lafayette, IN. Professionals from across the value chain will have the opportunity to come together to learn about insights and implications relevant to food and agricultural business, discover solutions to today’s challenges and gain knowledge on how to shape their organizations and customer interactions for optimal success. Register now!

: