As a land-grant university, we often work to understand and explain farmer behavior. Every four years, we look at farmer buying behavior, with the next study set for January. We also explore other issues important to agribusinesses who serve farmers and ranchers.

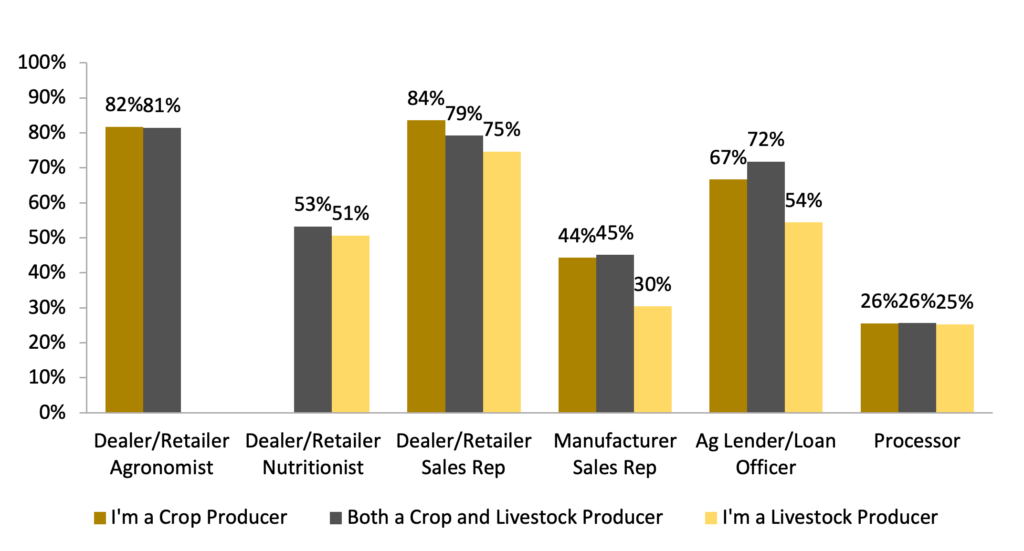

Recently, we asked farmers and ranchers about their relationships with agribusiness representatives like agronomists, nutritionists, sales reps, manufacturers, processors, or loan officers over the previous year.

Figure 1 shows how often different types of agricultural producers interact with various agribusiness professionals. These relationships play a vital role in supplying inputs and services, but also in disseminating knowledge. For the most part, local sources of this information are the most common. Producers interact with manufacturer sales reps about half as often as dealer/retailer sales reps.

Over 80% of farmers producing crops reported interactions with dealer/retailer agronomists, highlighting the critical nature of their roles in supporting agricultural practices. Half of livestock producers have interacted with dealer/retailer nutritionists, likely due to the common practice of livestock producers hiring independent nutritionists. In another survey question, 48% of livestock producers said they use independent nutritionists. Most farmers, across all categories, have interacted with ag lenders or loan officers, reflecting the importance of financial services in farming.

Figure 2 shows how often producers with different sized operations interact with various agribusiness professionals. In this study, gross farm revenue was used as the measure of size, with “Large” operations representing those over $5 million in revenue, “Commercial” operations $1 million to $5 million, “Mid-Size” operations representing farms $300K to $1 million, and “Small” operations as those under $300K. Dealer/retailer sales reps engage frequently with all sizes of operations, but less with smaller operations. Large (52%) and Commercial (42%) operations show greater interaction with manufacturer sales representatives compared to mid-size (31%) and small farms (37%).

The percentage of interactions with dealer/retailer agronomists decreases with the size of the operation. Large and commercial entities engage the most (84% and 81%, respectively), while small farms engage the least (43%).

Commercial and large operators report fewer interactions with dealer/retailer nutritionists compared to mid-size and small farms. This is likely influenced by larger farms hiring independent nutritionists, as mentioned earlier.

Most farmers and ranchers, except the smallest of them, frequently interact with ag lenders and loan officers, partly because there are typically higher credit needs and operating lines. Conversely, small farms interact more with processors, indicating they rely more on processing services.

Insights and implications for agribusinesses

Overall, the survey results reveal how different agribusiness roles interact with agricultural producers, reflecting the varying needs and dynamics of producers based on type and size. The findings illustrate nuanced relationships between producers and agribusinesses, emphasizing the importance of understanding support networks and decision-making processes within the agricultural sector. These insights point to opportunities for agribusinesses to provide tailored services and support for different scales of farming operations.

Key takeaways:

- Dealer/Retailer Sales Reps: Given their significant interaction with all types of producers, agribusinesses should prioritize maintaining strong sales teams and relationships with these reps to ensure effective supply and service distribution.

- Agronomy Services: With over 80% of crop farmers interacting with agronomists, agribusinesses should invest in and promote agronomy services to help farmers optimize production.

- Nutrition Services: Half of livestock producers interact with nutritionists. Agribusinesses providing feed and nutritional services should offer more customized or independent consulting options to meet the needs of larger farms.

- Financial Support: Consistent interaction with ag lenders and loan officers across most farm sizes underscores the importance of robust financial support and advisory services to help farmers manage their operations effectively.

- Processing Services for Small Farms: Small farms’ higher interaction with processors indicates a greater reliance on these services. Agribusinesses should explore opportunities to enhance processing services tailored for small farms to support their unique needs.

About the research

The Center for Food and Agricultural Business conducted a new research project last year as an extension of the 2021 Large Commercial Producer (LCP) survey. This research, titled the Farmer Decision-Making survey, is a deeper dive into the farmer decision-making process. The objective of the survey was to understand who influences producers’ decisions and explore when and how decisions are made on the farm. Conducted from March to August 2023, the survey collected data from 603 U.S. producers of various crops and livestock across the nation, including corn/soybean, wheat/barley, cotton, fruit/nut/vegetable, dairy, hogs and cattle.