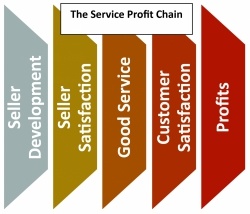

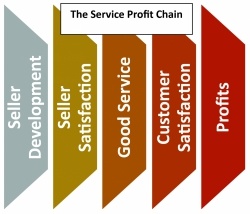

Dr. Scott Downey says there is a well-studied chain of events in business that shows the relationship between employee activities and company profits called the Service-Profit chain. The concepts are simple to understand: satisfied employees provide good service, which leads to satisfied customers, from whom more profits are generated. This research is foundational and has been studied in many different environments, including agribusinesses.

Dr. Scott Downey says there is a well-studied chain of events in business that shows the relationship between employee activities and company profits called the Service-Profit chain. The concepts are simple to understand: satisfied employees provide good service, which leads to satisfied customers, from whom more profits are generated. This research is foundational and has been studied in many different environments, including agribusinesses.

The main takeaway from this research is that developing employees isn’t a touchy-feely idea – it is a necessary activity that leads to profits. But in practice, what do agribusiness firms actually do to create satisfied employees who are responsible for managing profitable relationships with customers?

There are numerous components of employee satisfaction that are relevant: compensation (of course), job security, clear expectations, flexibility (today especially), meaningful work and professional growth. All of this is nice, and most managers believe themselves to be good or at least competitive on these topics – we have to be. But for salespeople, when it gets toward the end of the sales cycle, much of that goes out the window and the message from the boss is to get out there and sell. That’s what pays the bills, and it’s the reason we have salespeople.

Managers influence sales behavior in short term ways – motivating salespeople, coaching, dealing with price exceptions, advising salespeople on strategy, directing sales effort, etc. And managers influence sales behavior in longer term ways – offering training, hiring, developing compensation, etc. But managers also, well – manage. Management has four activities: setting goals and planning how to use resources to accomplish them, implementing those plans, measuring the outcomes and analyzing which activities will accomplish goals in the next round.

The sales management process in many agribusinesses has historically done a great job of determining what to sell and how much in order to reach goals and looking at the outcomes of that effort. One shift in thinking that must drive more of our management activity, though, is measuring not only the outcomes of the sales process, but the factors that lead to them. The quality of the sales effort, the factors that drive effectiveness and the conversations salespeople have with their customers are all inputs to the sales process that managers can (and should) be measuring and analyzing in order to identify not only what and how much gets sold, but how it is sold.

This is where the service-profit chain comes in. If profits come from satisfied customers, driven by satisfied employees, we must manage the process by which these are created. So, here are some areas that managers may want to consider measuring in order to manage them effectively:

Customer retention numbers are measured by many organizations. This metric looks at how many customers stay (or leave) year-over-year. Sometimes we even attempt to reach out to customers who have left us and ask why. Maybe it would also be useful to understand why customers stay.

Closely related to this metric are customer satisfaction ratings. It can be tempting to just ask simple questions, like “are you satisfied?” But these metrics may not be very productive. Instead, define how you want your organization to be seen, which marketers often call, “positioning,” and then test how or whether customers say they observe those factors. For example, if you want your organization’s people to be seen as performing better than competitors, ask a question about what ways customers have observed that.

If effective sellers are those who know their customers, ask salespeople to write down their customer’s goals – at least for the top 20 or so, and then conduct interviews with those customers to see how closely customer responses actually align with what salespeople said. If customer service is important, ask customers for examples of ways in which they have received service from your organization.

Sales call quality can be measured by asking for objectives of the call before it is made and comparing call reports with those to determine whether the objectives are accomplished. That doesn’t always mean selling something on the call; it could be gathering a key piece of information. The point of this information isn’t to catch people doing something well or poorly, but having data in these areas provides opportunities for managers and sellers to improve. This is how we get better.

Learn more from Scott Downey and Dave Downey by attending the Sales Management and Leadership online program December 14-15, 2021. Register today!

:

@ET-DC@eyJkeW5hbWljIjp0cnVlLCJjb250ZW50IjoicG9zdF9leGNlcnB0Iiwic2V0dGluZ3MiOnsiYmVmb3JlIjoiIiwiYWZ0ZXIiOiIiLCJ3b3JkcyI6IiIsInJlYWRfbW9yZV9sYWJlbCI6IiJ9fQ==@